To ESG Investors and Experts

Risk Management

Policies

Basic policy

As various risks surrounding our businesses increase, we strive to not only prevent damage to our brand, but also to increase our corporate value and reduce risks by preventing crises or promptly responding to those that are unavoidable. In addition, we fulfill our social mission by ensuring the safety of our customers, business partners and employees. We collaborate with local communities and business partners to ensure continuity.

ESG-related fines and settlement costs

In fiscal 2020, we did not incur any fines for environmental pollution for waste, air, soil, or other areas, nor did we incur fines for ESG in general.

Management

Risk management promotion structure

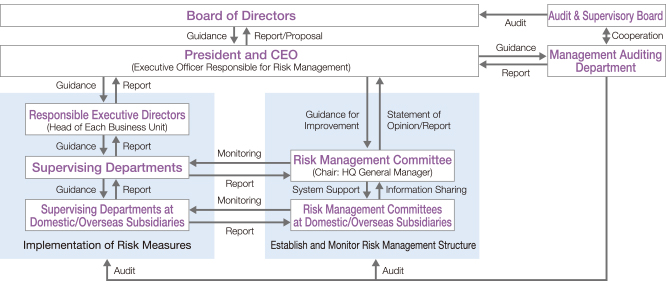

The chief executive officer is the executive officer responsible for overall risk management. In addition, the director in charge of each business unit is responsible for risk management at the business unit level. The structure provides a system and environment ensuring business continuity and the safety of human life. We have created Risk Management Rules to prevent crises and minimize damages in the event of a crisis, striving to reduce risk and mitigate any damages. We have established teams to address risk management by category, and we strive to prevent damage to our brand value and improve overall corporate value by managing risks of loss for the group as a whole. When an emergency presents the risk of significant loss, we engage in appropriate information sharing and decision-making according to our Risk Management Rules, taking proper steps to minimize damage. This risk management system refers to ISO 31000, which is a typical risk management framework.

The Group has established the Risk Management Committee, chaired by the HQ general manager of administration, as an organization to manage risk for the Group. This committee is responsible for identifying issues related to risk management at the Group level, engaging in discussions for potential solutions. Reports of the Risk Management Committee proceedings are provided to the Management Council, which is an advisory body to the CEO consisting of directors above the rank of executive managing director, full-time members of the Audit & Supervisory Board, and individuals appointed by the CEO. In addition, important issues are also reported to the board of directors and presented in our annual report. The department in charge of internal auditing drafts an annual audit plan based on the Internal Audit Rules and conducts internal audits to enhance the effectiveness of risk management. The department is also responsible for submitting the annual audit report to the board of directors.

The board of directors also oversees risks related to ESG (Environmental, Social, and Governance) in business activities.

The Management Auditing Department formulates an annual audit plan for enhancing the effectiveness of our risk management, and conducts internal audits that cover risk management processes. The annual plan is reported to the Board of Directors. In addition, the department verifies and assesses the effectiveness of internal controls to ensure that operations at the Company and its subsidiaries are conducted properly, and it makes recommendations for improvements and operational quality enhancements. The results of these audits are reported to the president, the director in charge, members of the Audit & Supervisory Board, and others. Feedback is provided to the relevant departments with follow-ups conducted on improvement progress. Audit results are then reported regularly to the Executive Council, the Board of Directors, and the Audit & Supervisory Board. The department works with members of the Audit & Supervisory Board, exchanging opinions and sharing information both regularly and on an ad-hoc basis.

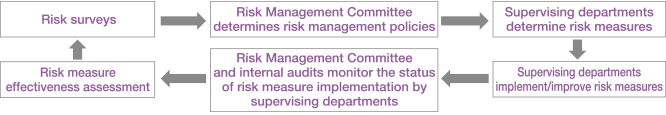

Risk Management Process

To carry out efficient and effective management of various risks, the Risk Management Committee identifies risk items that affect the Group in particular. The committee then makes recommendations to the president and CEO regarding systems for managing said risks. Subsequently, a department to be in charge of handling each risk item is selected. These departments are responsible for planning, executing, and reviewing risk measures, while the Risk Management Committee and internal audits are conducted to monitor the implementation status of the executive body, assessing risk measure effectiveness.

We categorize risks under one of three categories (management strategy risk, compliance risk, other risk) according to the nature of the risk to consider and monitor the progress of risk measures at each department related to the risk in question. A director in charge of management strategy risk is designated in accordance with the category. This individual reports the progress of risk measures to the board of directors on a quarterly basis. Compliance risks are reported at the Compliance Committee, and other risks are reported at the Risk Management Committee, with details and progress of risk measures discussed as necessary. All risk measures for each risk item are eventually aggregated and managed by the Risk Management Committee.

The implementation of risk measures is decided and carried out after internal approval by the respective supervising department for risk response.

Identifying Risk

When identifying risks, we narrow risks to those that impact the Group according to their nature. Our identification method is as follows.

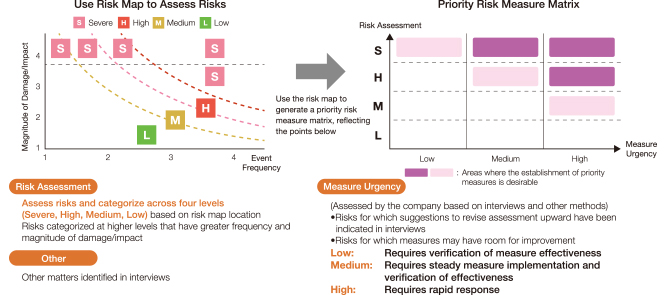

We conduct risk surveys (questionnaires and interviews) with directors, Audit & Supervisory Board members, and employees, assessing risks quantitatively and qualitatively.

Based on the results of risk surveys, we create a risk map based on the frequency and magnitude of damage or impact of each risk. We evaluate risks and identify those risks that require countermeasures.

Based on the status of existing measures for identified risks, we create a priority risk measure matrix based on the need for measures, identifying the risks that should be prioritized.

Based on the preceding, we have identified 92 risk items and have adopted risk measures according to priority. Risk assessments will change as our business environment changes. Therefore, priority risks measures will be updated as necessary in parallel with risk surveys.

Compliance promotion system

The Company emphasizes compliance and respect for the AEON Code of Conduct , fostering improving relations with local communities and meeting the company’s social responsibilities.

In addition, the Compliance Committee, chaired by the HQ general manager of administration, has been established to confirm the status of compliance with laws, regulations, the Articles of Incorporation and group internal regulations, as well as identify problems and discuss improvement measures. The proceedings of the Compliance Committee are be reported to the Management Council. Important matters are reported to the board of directors along with the submission of an annual report related to the matters above.

In addition, we have established the Helpline/AEON MALL Hotline as an internal reporting contact point. A Union 110 Hotline has also been separately launched by our labor union. The Helpline/AEON MALL Hotline and Union 110 Hotline is available to all employees, including community employees, contract employees, flexible employees, temporary employees, and part-time employees. We have also installed similar helpline systems at our subsidiaries. We ensure that users of these helplines are not subject to reprisal. In the event a report is filed via this channel, we carefully investigate the details reported. Where unacceptable behavior is proven, we take disciplinary action according to internal rules. We (or the department in question) also draft measures to prevent recurrence, shared for company-wide implementation. The Compliance Committee also receives a report of the measures.

Since 2003, we have conducted an annual, anonymous review (the AEON Code of Conduct Survey), to ascertain the implementation status of the AEON Code of Conduct, issues in the workplace, employee work habits, and work satisfaction. This survey provides fundamental data for our activities in this area. It is used to evaluate workplace culture and employee awareness throughout AEON, including our overseas subsidiaries. The survey measures the recognition of corporate promotion activities, individual awareness, and workplace conditions. The results of this tabulated analysis are shared with group companies to help solve specific issues.

In fiscal 2020, we conducted questionnaires with 67 overseas Group companies, receiving responses from 54,402 employees. We will similarly conduct questionnaires in fiscal 2021 and beyond, and based on our analysis of their results, we will build a system for ascertaining the actual situation at each company, plan and implement measures to reform workplace culture, and strengthen our response to compliance risks.