Among the matters related to the conditions of business and the status of accounting, etc., which have been stated in the AEON MALL (the “Company”) Annual Securities Report, the following are those important matters deemed to have a potentially material impact on the decision-making process of investors. The risk factors and uncertainties that may impact the future business performance and/or the financial position of the Company are not limited to the items described below. Further, matters discussed here that are not historical fact reflect the judgment of AEON MALL Group ("AEON MALL Group," or “Group”) management as of the date of submission of the latest annual securities report (May 24, 2024).

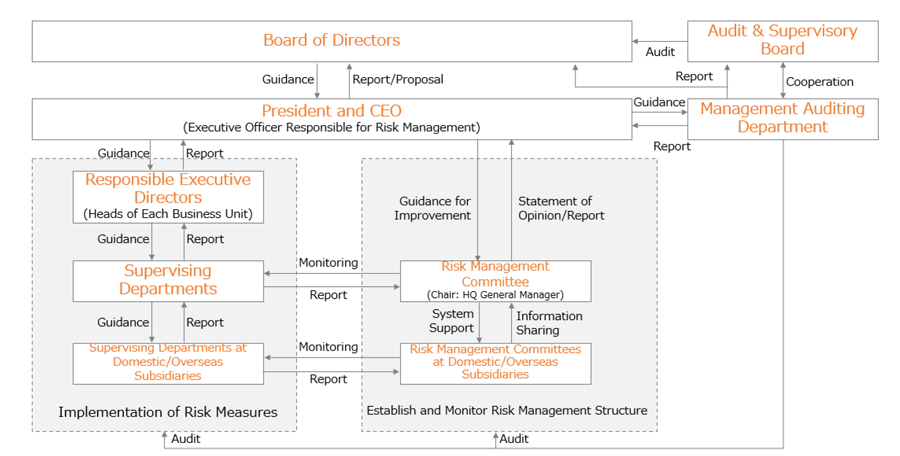

The Company’s president and CEO is the executive officer responsible for risk management under the Group’s system for managing the risk of loss. The director over each business unit and the person responsible for general management under each business unit are executive directors. By separating the execution and supervision of risk management, we strengthen our systems and environment further to ensure business continuity and the safety of human life. The Group has created Risk Management Rules to prevent crises or minimize damage in the event of a crisis, striving to reduce risk and mitigate any damages.

Specifically, we have selected risk categories having a high impact on the Group and have established departmental teams to address risk management by category. Each team executes PDCA cycles for risk measures. The executive officer in charge is responsible for implementation, while the director in charge is responsible for monitoring progress and effectiveness. In this way, we strive to prevent damage to our brand value and improve overall corporate value by managing the risk of loss for the Group as a whole.

Furthermore, in the event of an emergency presenting a risk of significant loss, we engage in appropriate information sharing and decision-making according to our Risk Management Rules, taking proper steps to minimize damages.

■ Establishment of the Risk Management Committee and Overview of Activities

The Company has established the Risk Management Committee, chaired by the director in charge of administration. The purpose of this committee is to maintain and improve risk management systems, including determining the status of risk management operations across the Group and reviewing risk management systems on a continual basis. The details of this committee are as follows. The Risk Management Committee analyzes risk status, conducts ongoing activities to avoid risks, provides opinions to the president and CEO, and deliberates issues related to risk management promotion systems and measures. Risk Management Committee discusses risk measures to address major incidents, etc., leading to highly effective risk measures.

Furthermore, for crises that require immediate judgment, e.g., during an earthquake, a separate emergency response office will be established to provide a rapid, appropriate initial response, to prevent escalation, and to aid an early resolution.

The Risk Management Committee holds activities approximately five times each year, with the committee reporting to the board of directors at the beginning of each fiscal year (March) regarding details of initiatives in the previous fiscal year and policy regarding initiatives in the current fiscal year. Domestic and overseas subsidiaries such as OPA Co., Ltd. and companies outside Japan have established Risk Management Committees by country. The details of committee deliberations are shared with the Company's Risk Management Committee.

The members of the Company's Risk Management Committee are as follows.

- Committee chair: Director in charge of administration

- Members:

A) Heads of supervising departments for risk response as defined in the Risk Management Rules

B) Managers over the Risk Management Secretariat of subsidiaries with risk management committees

C) Persons nominated by the chair - Secretariat: Legal Department

(Note) To improve the effectiveness of the risk management system, committee members or managers of the Risk Management Secretariate of subsidiaries with Risk Management Committees are selected for each risk that has a high impact on the Group, and are responsible for preventing risks during normal times and for handling situations proactively when risks occur.

Risk Management Promotion System Diagram

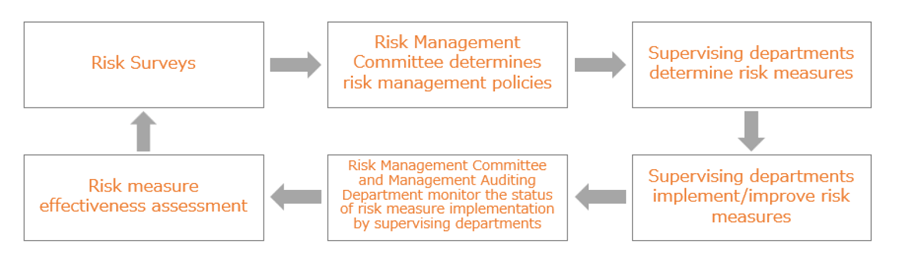

■ Risk Management Process

To carry out efficient and effective management of various risks, the Risk Management Committee identifies risk items that affect the Group in particular. The committee then makes recommendations to the president and CEO regarding systems for managing said risks. Subsequently, a department to be in charge of handling each risk item is selected. These departments are responsible for planning, executing, and reviewing risk measures together with the executive officer in charge, while the Risk Management Committee, director in charge, and Management Auditing Department monitor the implementation status of the executive body, assessing risk measure effectiveness.

We categorize risks under one of three categories (management strategy risk, compliance risk, other risk) according to the nature of the risk to consider and monitor the progress of risk measures at each department related to the risk in question. The Management Strategy Advisory Committee discusses and exchanges opinions on important policy and management issues, taking note of said discussions when considering approaches to and the direction of initiatives for each topic. The committee designates an executive officer to be in charge of each area, and said executive officer makes a quarterly report on the progress of risk measures to the Board of Directors.

The committee notes risks in consideration of approaches and directions for initiatives in each category, designating an executive director in charge according to risk category. The designated executive director reports quarterly on the progress of risk response measures to the board of directors.

The implementation of risk measures is decided and carried out after internal approval by the respective supervising department for risk response.

Risk Management Process Diagram

■ Identifying Risk

When identifying risks, we narrow risks to those that impact the Group according to their nature. Our identification method is as follows.

- Identifying risks

We conduct risk surveys (questionnaires and interviews) with directors, Audit & Supervisory Board members, executive officers, and employees, assessing risks quantitatively and qualitatively. - Using a risk map to assess risks

Based on the results of risk surveys, we create a risk map based on the frequency and magnitude of damage or impact of each risk. We evaluate risks and identify those risks that require countermeasures. - Establishing priorities using a priority risk measure matrix

Based on the status of existing measures for identified risks, we create a priority risk measure matrix based on the need for measures, identifying the risks that should be prioritized.

With respect to the preceding, we identify specific risks through risk surveys and implement countermeasures to address these risks. The Company conducted a subsequent risk survey in FY2021 to review the status of risks in our organization, reflecting the results in an updated list of 91 risks, measures against which are being implemented. The Company intends to conduct risk surveys regularly according to changes in business over several years, aiming to reflect the results of these surveys in the Company’s medium- to long-term management plans. To respond to the changing business environment, the Risk Management Committee regularly reviews risk items and risk assessments once a year, even in years when a risk survey is not conducted. The committee then updates priority risks as needed in response to changes in the environment, including the actual occurrence of risk-related incidents.

Based on the latest business environment in Japan and overseas, we have identified risks that may impact the Group's business activities and that require company-wide management. Of the risk items identified according to risk map assessment and priority risk measure matrix, certain risk items requiring risk assessment and measures in particular. After the Risk Management Committee considers these risks, we categorize them as follows.

| Type | Risk Item | Risk Assessment | Measure Urgency |

| Business strategy risks | a. Risks related to changes in the business environment | S | High |

| b. Risks related to real estate development and investment | S | High | |

| c. Risks related to securing and cultivating human resources | S | High | |

| d. Governance-related risks | H | High | |

| Risks related to finances | e. Impairment risks | S | High |

| f. Risks related to capital procurement, interest rate fluctuations, and exchange rate fluctuations | S | Medium | |

| Operational risks | g. Risks related to the occurrence of natural disasters, accidents, and terrorism | H | High |

| h. Risks related to the occurrence of war, civil disorder, and coup d'étati. | S | Medium | |

| i. Risks related to the spread of infectious diseases | S | Medium | |

| j. Risks related to information security | H | High |

Business Strategy Risks

a. Risks related to changes in the business environment

| Risk Assessment | S | Measure Urgency | High |

| Risk Scenarios | (Domestic and overseas business environment) In the Group's external business environment, certain overseas retail markets exhibit high growth potential due to strong economic development. However, concerns exist related to accelerated store openings by competing developers in and outside Japan, as well as a slowdown in growth due to global economic recession. Japan is experiencing changes in demographics and family structures due to population decline, low birthrates, and an aging population. In addition, changes in consumer behavior are accelerating, including the expansion of e-commerce, OMO, the rise of the sharing economy, and the polarization of consumption modes. In addition, technological developments in digital technology—AI, in particular—further accelerate changes in the way society works and the way people work. We can only expect the importance of risk management in terms of information security to expand as well Failure of the Company to adequately respond to these changes in the business environment may affect the Group's business performance and financial position. (Trends in tenant companies) Major tenants of malls managed and operated by the Group are retail and service companies, which tend to be sensitive to economic and personal consumption trends. Therefore, economic downturns and intensifying competition with other real estate developers and retailers could result in a negative impact on the Group's business performance or financial position, including a worsening of tenant leasing terms or an increase in vacant spaces. (Response to sustainability issues) We understand the need to strengthen our response to environmental issues, including climate change and conservation of biodiversity, and social issues, including the use of human resources, which is our most important management resource, respect for human rights, and fair and appropriate business practices. Failure to address these issues adequately may result in a decline in support of the Company by customers, local communities, partners, employees, shareholders, investors, and other stakeholders, and may affect the Group's business performance and financial position. |

||

| Measures | (Domestic and overseas business environment) We (1) pursue regional shift in Japan and overseas and (2) create a Health and Wellness platform, aiming for sustainable growth through truly integrated ESG management that creates economic, social, and environmental value for our stakeholders. Overseas, economic policies continue to develop centered on the development of social infrastructure. Accordingly, we are pursuing property development and opening new locations in areas of advancing urbanization with high market growth potential. We strive to differentiate ourselves from competing developers through competitive malls that leverage our expertise in mall management and operations cultivated in Japan, as well as through digital transformation initiatives. We view the accelerating changes in the Japanese business environment as opportunities, and we strive to strengthen our ability to drive traffic by creating new customers and improve profitability by introducing reforms into existing business models to respond to developing regional issues, customer values, and latent needs. We also reform these business models to respond to business issues faced by our partner companies. In an era of rapid and uncertain change throughout the world, we not only develop existing businesses, but also focus on creating new businesses for new value and new initiatives to expand our business domains. In the digital realm, we are developing marketing strategies that leverage the AEON Mall app and AEON Group data assets to provide new value to the needs of each customer. In addition, we strive to ensure privacy and security, while aiming to establish a new way of working through AI and other digital technologies to improve the productivity of not only our employees, but also that of our partner companies, including tenant companies. (Trends among tenant companies) In terms of leasing, we work to create attractive malls from the customer standpoint by attracting new tenants. We provide added value through new business formats, taking advantage of our relationships with tenant companies in Japan and overseas. (Response to sustainability issues) We have conducted materiality analysis in consideration of the SDGs and social issues in Japan and overseas, evaluating degrees of materiality for our stakeholders and the Company. We established materialities consisting of ten matters across five categories, defining these matters as important issues from an ESG perspective by evaluating the level of importance to our stakeholders and the Company. We seek to conduct truly integrated ESG management, communicating issues throughout the Company and executing measures to solve these issues through co-creation with our stakeholders. |

||

b. Risks related to real estate development and investment

| Risk Assessment | S | Measure Urgency | High |

| Risk Scenarios | Mall and office/retail facility development requires significant time and investment prior to opening. Tasks include market research, site selection, negotiations with landowners, legal proceedings, mall and office/retail construction, and tenant recruitment. Therefore, recouping investment requires a certain period of time. If the development schedule is delayed due to unseasonable weather, natural disasters, environmental pollution in the development area, delays in obtaining licenses, coordination with local residents, or other local factors, or if real estate prices or construction costs rise, the cost of acquiring and renting real estate may increase, potentially having a negative impact on the Group's business performance or financial position. Similarly, recovering investments in renovations for existing stores requires a certain period of time due to the extended period of renovation construction and the significant amount of investment involved. An increase in renovation costs due to delays in renovation schedules or an increase in construction costs may affect the Group's business performance and financial position. In the future, facilities and equipment such as air conditioning and heating equipment may deteriorate as the mall ages, increasing the possibility of breakdowns and accidents. In this event, repair costs will rise, potentially having a negative impact on the Group’s business performance or financial position. |

||

| Measures | To prevent delays in the schedule of future new properties and property renovations, the AEON MALL Group works closely with each department to manage progress, clarifying the departments responsible for investment return plans for new mall openings and renovations in Japan and overseas, formulating optimal plans in terms of revenue and cost, and examining measures to reduce costs. We established a system to move forward with business operations once the Board of Directors and the Management Council have deliberated on the appropriateness of profit-and-loss plans and the feasibility of investment recovery based on these strict investment return standards. To deal with the increase in repair costs associated with the age of malls, we established repair rules for malls and other facilities that pass a certain age. Under these rules, we address the issue systematically, placing the highest priority on safety and security. | ||

c. Risks related to securing and cultivating human resources

| Risk Assessment | S | Measure Urgency | High |

| Risk Scenarios | The Group is pushing forward with the creation of a foundation for the expansion of business bases and the strengthening of profitability in domestic business and overseas business in China and ASEAN, which are growth drivers. It will be necessary to secure and develop human resources who can demonstrate strong management skills and leadership from a global perspective. Particularly in Japan, the working population is decreasing due to declining birthrates and an aging population. If we are unable to secure and train the human resources necessary for business expansion, such may have a negative impact on the Group's business performance or financial position. |

||

| Measures |

In the belief that human resources are the greatest management resource for achieving sustainable growth, the Group seeks to become a company in which diverse human resources can enjoy healthy lives as they continue to demonstrate their talents. We pursue a growth strategy by investing in human resources to this end. To secure human resources, we are strengthening systems to recruit new graduates, who will become our next generation of leaders, and to hire career professionals, who will be responsible for helping us expand into new business areas. In terms of human resources development, we pursue diversity management to respond to rapid social changes and innovate our business model. We are developing systems and work environments by which a diverse base of employees can express their individuality, demonstrate their capabilities, and play active roles. In addition, we engage in health management, believing that the foundation of our corporate activities is to create workplace environments in which employees work comfortably and in good physical and mental health. We provide training according to position and level of growth and conduct human resources training for persons who will become future leaders in our overseas businesses. We have also created various human resources development and education programs (e.g., the AEON Business School) for cultivating candidates for future top managers. In the transfer and assignment of personnel, we are expanding internal recruitment systems to encourage employees in the self-development of their careers and to increase motivation in daily work. To ensure transparency and fairness in cultivating future managers, we also discuss the necessary standards, career plans, cultivation policies, and plans for managers at the Nomination and Compensation Committee, which consists mainly of independent outside directors. |

||

d. Governance-related risks

| Risk Assessment | H | Measure Urgency | High |

| Risk Scenarios | (AEON MALL Group governance) If the board of directors fails to make management decisions in line with the corporate philosophy and management strategy due to a lack of sufficient and appropriate information and dysfunctional supervision of the business execution divisions, or if the check and control function does not function properly due to inadequacies in the rules of authority, decision-making, and approval processes, etc., such could result in serious incidents or scandals, which may affect the Group’s business performance, financial position, or creditworthiness. In addition, if the performance of one or more subsidiaries deteriorates significantly due to a serious incident or scandal arising from the Group’s inability to understand business operations of a subsidiary, or due to the inability to generate synergies in the event of an acquisition or merger, such may affect the Group’s business performance, financial position, or creditworthiness. (Governance over transactions with AEON Co., Ltd. and its affiliates) The AEON MALL Group belongs to a corporate group consisting of AEON Co., Ltd. and its consolidated subsidiaries (“AEON Group Companies”). The AEON MALL Group manages and operates shopping malls by leveraging close relationships with parent company AEON Co., Ltd. There is a potential for conflict of interests between the parent company and minority shareholders of the AEON MALL Group. If we cannot sufficiently secure our independence from the parent company, and terms and conditions of transactions are such that the rights and interests of minority shareholders of the Company are infringed upon, such may affect the Group’s business performance and financial position. The role of anchor tenants with the ability to attract customers is extremely important in developing malls. We expect AEON and AEON STYLE general merchandise stores, owned and operated by AEON Co., Ltd. subsidiary AEON Retail Co., Ltd., to become anchor tenants in our malls.The business performance, store opening policies, and store closure policies of these anchor tenants may have a negative impact on the Group's business performance or financial position. |

||

| Measures | (AEON MALL Group governance) The Company's board of directors consists of 12 directors, five of whom are independent outside directors. The Company strives to obtain advice and recommendations from outside directors possessing a wealth of experience and deep insight in a variety of fields to ensure appropriateness and validity in decision-making. In addition, the Company will introduce an executive officer system on May 21, 2023, to separate management supervision from business execution and to strengthen the supervisory function by directors. In accordance with Rules for the Management of Affiliates, the Company confirms matters approved in the management of subsidiaries, carrying out approval procedures in accordance with the rules of authorization. In transactions with subsidiaries, the Company ensures the objectivity of transaction terms in accordance with the provisions of our Rules for Managing Related-Party Transactions. As a system to ensure the efficiency of the performance of duties by subsidiaries, the Company approves AEON MALL Group medium-term management plans, annual management goals, budget distribution, etc., that include subsidiaries at the meetings of the board of directors, inspects the progress of business strategies and measures in line with such plan and goals on a quarterly basis, and receives reports on other important information. (Governance over transactions with AEON Co., Ltd. and its affiliates) In November 2021, the Company established a Governance Committee consisting solely of independent outside directors. The purpose of this committee is to supervise important transactions and actions that may conflict with the interests of controlling shareholders and minority shareholders. The committee met eight times during fiscal 2023. These types of transactions and actions are deliberated and reviewed by the committee according to the degree of importance. After confirming that the fairness and reasonableness of such transactions are ensured from the perspective of improving the Company's corporate value, the transactions are deliberated and approved by the board of directors. In this way, we have strengthened the supervisory function of the board. The Company ensures the objectivity of transaction terms between related parties, including the AEON Co., Ltd., in accordance with provisions of our Rules for Managing Related-Party Transactions. The Company makes our own independent management decisions related to daily business operations. We confer with or report to AEON Co., Ltd. concerning key management issues. AEON Co., Ltd. and AEON Group Companies strive to achieve sustainable growth, development, and improved financial results, while maintaining close cooperation and respecting mutual independence and unique approaches. When developing malls, leveraging Aeon and AEON STYLE as core tenants provides advantages in terms of securing stable rent income, using the traffic-driving power of the AEON market area, strengthening incentives for customers to visit malls on weekdays for daily needs, and allowing the AEON MALL Group to serve as disaster-relief facilities in the event of an emergency. AEON Retail Co., Ltd. accounted for 9.1% of the Group's operating revenue for the fiscal year ended February 29, 2024, while the total of AEON Group Companies other than AEON Retail Co. accounted for 10.9% of total operating revenue. |

||

Risks Related to Finances

e. Impairment risks

| Risk Assessment | S | Measure Urgency | High |

| Risk Scenarios | In the event of ongoing operating losses at malls due to significant worsening of the business environment, increasing vacancies due to tenant closures, etc., or due to a significant drop in the market price of mall sites, or in the event of an increase in the discount rate due to interest rate fluctuations, etc., the resulting impairment losses for fixed assets held by the Group for business purposes could have a negative impact on the Group's business performance, financial position, or creditworthiness. | ||

| Measures | The Group formulates plans reflecting optimized costs and revenues after determining and analyzing possible risk scenarios. For investment projects over a certain amount, we also deliberate the appropriateness of the profit and loss plan and the feasibility of the return on investment at meetings of the board of directors and the Management Council. In this way, we strive to improve the accuracy of investment profitability plans. We verify the operating status of malls that have been opened at company-wide meetings. The results of investment profitability verifications for malls that have been open for a certain period of time are reported to the board of directors. We established a system to monitor malls giving rise to concerns related to impairment to check performance and progress in implementing measures and to report the results of activities to the Management Council. We also form a response project team (value-building project team) to take action, primarily to improve profitability as we strive to reduce the risk of impairment. |

||

f. Risks related to capital procurement, interest rate fluctuations, and exchange rate fluctuations

| Risk Assessment | S | Measure Urgency | Medium |

| Risk Scenarios | The Group procures capital to support mall development based on the Group's growth strategy, primarily via borrowings from financial institutions, the issuance of corporate bonds, leases, or capital increases. However, there instances may occur in which a destabilization in financial market conditions, worsening in the Group's business outlook, or deterioration in the Group's creditworthiness, etc., may result in the Group being unable to procure funding in a timely manner under desirable terms. In the event of an increase in market interest rates, the increased cost of capital for financing or refinancing mall development and higher rents paid to property owners under lease contracts could have a negative impact on the Group's business performance or financial position. In addition, the Group is expanding its overseas business in China and ASEAN, regions driving future growth. This expansion is leading to an increasing volume of foreign currency-denominated transactions in areas like materials procurement for overseas development properties. These transactions are affected by exchange rate fluctuations, which may have a negative impact on the Group's business performance or financial position. |

||

| Measures | In principle, the Group procures capital at fixed interest rates and hedges exchange rate fluctuation risk in part through exchange contracts and currency swaps. While we diversify the methods and sources of our capital procurement (borrowings), we make efforts to maintain and improve credit ratings by controlling our balance of interest-bearing debt, etc., to ensure needed financing facility. Furthermore, we have established commitment lines enabling immediate procurement of necessary working capital even during dramatic changes in the financing environment. | ||

Operational Risks

g. Risks related to the occurrence of natural disasters, accidents, and terrorism

| Risk Assessment | H | Measure Urgency | High |

| Risk Scenarios | Since the Group conducts business both in Japan and overseas, the malls we manage and operate may suffer damage (including to damage to reputation), destruction by fire, deterioration, or other serious harm as a result of events occurring in the respective mall's country or region. These incidents include natural disasters such as large-scale earthquakes, typhoons, and torrential rains, as well as human accidents such as fire and power outages, and even acts of violence or terrorism that endanger human life. Such events could force a suspension of business, having a negative impact on the Group's business performance or financial position. | ||

| Measures | The Group has established and is working to strengthen our risk response systems to minimize harm caused in the event of emergencies. We have established and communicated our crisis management administration rules and Risk Management Rules that address natural disasters, epidemics, accidents, etc. Further, we conduct drills in cooperation with police, fire departments, and other administrative agencies in preparation for large-scale earthquakes and terrorist attacks. Measures taken to protect buildings and facilities include seismic retrofitting and fire protection soffit slabs to mitigate harm in the event of a large-scale earthquake. We also install plate water stops in malls at risk of flood damage. In addition, the Group has purchased joint Aeon Group insurance policies for fire insurance covering all malls we operate, profit insurance to compensate for lost rents, etc., in the event of a disaster (excluding earthquakes), and earthquake insurance to compensate for damage caused by earthquakes and tsunami. These insurance policies ensure coverage in the event that risks become a reality. |

||

h. Risks related to the occurrence of war, civil disorder, and coup d'état

| Risk Assessment | S | Measure Urgency | Medium |

| Risk Scenarios | Since the Group conducts business both in Japan and overseas, the malls we manage and operate may suffer damage (including to damage to reputation), destruction by fire, deterioration, or other serious harm as a result of events occurring in the respective mall's country or region, including war, civil disorder, and coup d'état. Such events may lead to long-term mall closures, wider vacancies due to the withdrawal of tenants in Japan and/or overseas, and costs incurred to rebuild damaged malls. This could have a negative impact on the Group's business performance or financial position. | ||

| Measures | Particularly when developing business overseas, the Group pursues business in partnership with local governments, local companies, and other business partners. We strive to collect information through close communication with these parties. In addition, we have completed development of various regulations and manuals, including Risk Management Rules and emergency response manuals. We revise these documents as needed based on incidents that have occurred. In addition, the Company strives to maintain and improve systems for appropriate responses in case of emergency. We do so through drills based on our business continuity plan (BCP) in each country, by educating employees on crisis management, and through other measures. |

||

i. Risks related to the spread of infectious diseases

| Risk Assessment | S | Measure Urgency | Medium |

| Risk Scenarios | The Group is engaged in the mall business both in Japan and overseas. In the event of an outbreak of a large-scale and severe infectious disease in countries and regions where the Group operates malls, national or municipal government lockdown orders, requests to restrict activities, or other actions could limit customer movement outside their homes. Such developments could lead to changes in customer values and consumption behavior. In the event that the malls managed and operated by the Group are forced to close temporarily, to shorten business hours, or to change plans for mall openings, such may have a negative impact on the Group's business performance or financial position. | ||

| Measures | Based on the Aeon COVID-19 Prevention Protocol, a standard for quarantine measures developed in response to the global explosion in COVID-19 infections (pandemic) beginning in 2020 by Aeon to protect the health and livelihoods of tenants and Company employees, the AEON MALL Group continued to improve mall environments and operating systems. Learning from this experience we prepared response measures in advance and by route of infection (contact infection, droplet infection, etc.), materials and equipment, and measures according to the nature of each infectious disease. By gathering information in preparation for new outbreaks or pandemics, we strive to build a system that allows us to continue business operations with effective quarantine measures in place. | ||

j. Risks related to information security

| Risk Assessment | H | Measure Urgency | High |

| Risk Scenarios | The importance of the digital transformation (DX) and the Group's information systems within our overall business operations has increased dramatically. In the event of a large-scale natural disaster or similar occurrence, data centers could be damaged and information system operations could be interrupted. If the personal information of our customers or employees, confidential business information, or other information is leaked or altered as a result of rising risks of cyberattacks targeting the overall Group supply chain, including subsidiaries, or other unforeseen circumstances, the Group's social credibility may be damaged, and the Group may become responsible for paying significant compensation for damages. Such events could have a negative impact on the Group's business performance or financial position. |

||

| Measures | To address the risk of information system outages, we have backup data centers in standby operation at remote locations in addition to data centers in primary operation. By establishing a system allowing recovery, even in the event of failure at the primary data center, we have further strengthened our current business continuity plan (BCP), striving to minimize the impact of large-scale natural disasters on Group businesses. With respect to risks such as information leakage and alteration, we have implemented a number of measures against cyberattacks, such as EDR (Note) and multi-factor authentication on work computers, logging tools for network communications, and limitations on the use of external recording media in work computers. These measures include regular security checks by relevant departments when adopting outside systems, the latest security patches to applications and other software used, information security education programs for employees, and regular information system security checks. |

||

(Note) An abbreviation of Endpoint Detection and Response. This is a security solution that protects users within companies and organizations, various terminals and devices, data, and other important company assets from cyberattacks not detected by antivirus software or security tools for endpoints (PCs, smartphones, IoT devices, etc.).