Indicators & Quantitative Targets

Targets and KPIs

Quantitative Medium- and Long-Term Targets

Overseas, we aim to increase the number of new malls by capturing growth markets in ASEAN and other regions. In Japan, we aim to become the dominant mall in each region through aggressive expansion and renovation, achieving operating revenue and operating income levels on par with the top global commercial developers.

| FY2023 Actual | FY2024 Actual | ||

|---|---|---|---|

| Earnings | Operating revenue | ¥423,168 million | ¥449,753 million |

| Operating income | ¥46,411 million (11.0% margin) |

¥52,146 million (11.6% margin) |

|

Financial Indicators

| Measure | Type | Target | FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | FY2024 |

|---|---|---|---|---|---|---|---|---|

| EPS Growth Rate | Growth | 7% average annual growth (indexed from 2019) |

2.1% (YoY) |

-* | ▲25.0% | ▲27.6% | ▲12.1% | ▲16.1% |

| Net interest-bearing debt/ EBITDA ratio |

Safety | 4.5 times or lower | 4.7 times | 6.2 times | 6.6 times | 6.0 times | 6.2 times | 5.8 times |

| ROIC | Efficiency | At least 5% | 4.3% | 2.2% | 2.4% | 2.5% | 2.5% | 2.7% |

EPS: Net income attributable to owners of parent/average outstanding shares during the year

Net interest-bearing debt/EBITDA ratio: (interest-bearing debt - cash and cash equivalents) / (operating income + depreciation and amortization on the statement of cash flows)

ROIC: Operating income x (1-effective tax rate) / average equity for the fiscal year + average interest-bearing debt for the fiscal year)

* We did not calculate EPS growth rate for FY2020 as we recorded a net loss per share in FY2020.

New Mall Opening Plan (as of February, 2025)

We aim to increase malls through aggressive investments in growth, mainly in the growth-driving ASEAN region, as well as regions of China where we have yet to enter the market.

Japan Mall Opening Plan

| Total No. of Malls in FY2022 (Cumulative) |

FY2023 to FY2025 |

Total No. of Malls by FY2025 (Cumulative) |

|||

|---|---|---|---|---|---|

| FY2023 | FY2024 | FY2025 | |||

| 94 | 4 | 0 | 2 | 6 | 98 |

* In addition to the above, we contract the management and operations of 49 commercial facilities of AEON Retail and AEON Tohoku.

* Shopping Mall Festa will cease operations temporarily on August 31, 2023, for renovation into a new commercial facility.

* QUALITE PRIX terminate management and operation on June 30, 2024.

China Mall Opening Plan

| Total No. of Malls in FY2022 (Cumulative) |

FY2023 to FY2025 |

Total No. of Malls by FY2025 (Cumulative) |

|||

|---|---|---|---|---|---|

| FY2023 | FY2024 | FY2025 | |||

| 22 | 1 | 2 | 1 | 4 | 25 |

* AEON MALL Beijing International Mall (China) will cease operations on June 24, 2023, when the lease agreement with the building owner expires.

ASEAN Mall Opening Plan

| Total No. of Malls in FY2022 (Cumulative) |

FY2023 to FY2025 |

Total No. of Malls by FY2025 (Cumulative) |

|||

|---|---|---|---|---|---|

| FY2023 | FY2024 | FY2025 | |||

| 13 | 1 | 2 | 0 | 3 | 16 |

New Malls Under the 2023-2025 Three-Year Medium-Term Management Plan

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Japan | • Toyokawa • THE OUTLETS SHONAN HIRATSUKA • CeeU Yokohama • JIYUGAOKA de aone |

- | • Suzaka • Sendaikamisugi |

| China | • Wuhan Jiangxia | • Hangzhou Qiantang • Changsha Xingsha |

• Changsha Xiang Jiang Xinqu |

| ASEAN | • Sihanoukville FTZ Logistics Center (Cambodia) |

• Delta Mas (Indonesia) • Hue (Vietnam) |

- |

Indicators & Quantitative Targets

Policies & Specific Measures

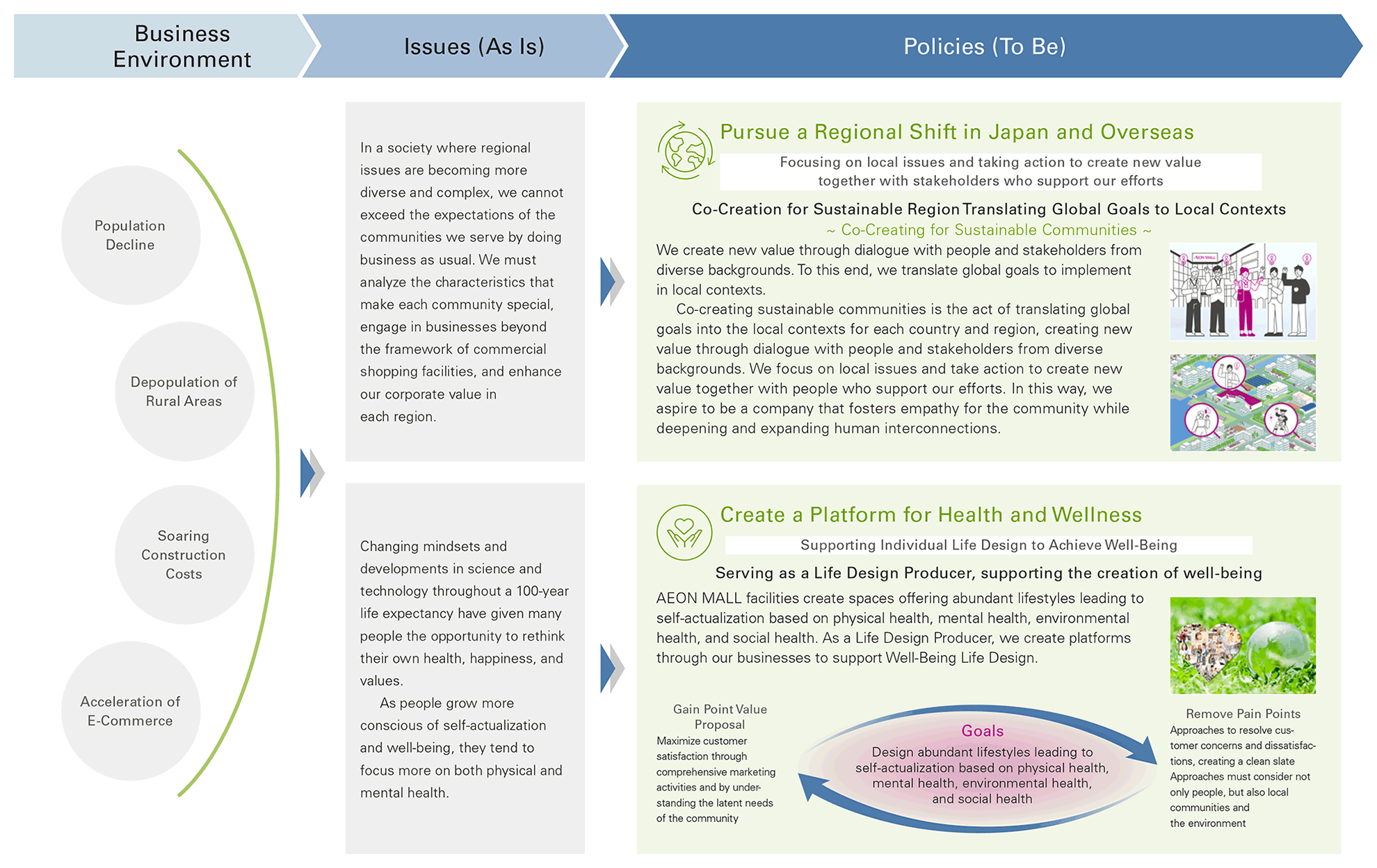

We engage in ESG management as a measure of growth. To evolve ESG management further, we (1) pursue regional shift in Japan and overseas and (2) create a Health and Wellness platform,aiming for sustainable growth through truly integrated ESG management that creates economic, social, and environmental value for our stakeholders.

Initiatives

Initiatives

Pursue a regional shift in Japan and overseas

Create a Platform for Health and Wellness

※横スクロールでご覧いただけます

Growth Initiatives(Priority Measures)

Growth Initiatives(Priority Measures)

Discover and Commercialize Business Opportunities in Overseas Growth Markets

Accelerate the opening of new malls in areas with high growth potential, and search for and develop new business opportunities that respond to the challenges of each country and region

We continue to search for and secure properties in high-growth areas, accelerating new mall openings. In Vietnam, our most important area for new mall openings, we are pursuing area-dominant mall openings focused on Ho Chi Minh City in the south, Hanoi in the north, and cities in the central area of the country. In China, we plan to accelerate the opening of malls in the high-growth inland regions of Hubei and Hunan Provinces, treating these provinces as priority areas. We intend to move away from a single mall format to a new value creation model tailored to the characteristics of each region, exploring new business opportunities outside the framework of commercial facilities through deeper research into the issues facing each country and region.

Expanding Mall Openings in the High-Growth Inland Regions of China

We opened AEON MALL Wuhan Jiangxia, our fourth mall in Hubei Province, on November 11, 2023. The mall features entertainment facilities for adults and children alike, as well as a variety of food experience zones. The mall also offers five themed atrium spaces and a rooftop park offering a basketball court, event space, a multi-purpose lawn area, and park space for a variety of other purposes, representing a space where customers of all ages can interact. We plan to open our first mall in Hunan Province, AEON MALL Changsha Xingsha (Changsha City, Hunan Province), in 2024, and a second mall, AEON MALL Changsha Xiang Jiang Xinqu (Changsha City, Hunan Province), in 2025. Hunan Province is located in central China, and Changsha City, the capital of Hunan Province, is experiencing strong economic growth. The population of the province increased by more than 3 million in the last 10 years. AEON MALL signed a comprehensive cooperation agreement with the Changsha Municipal People’s Government in May 2021, and we plan to continue opening new malls.

Hubei Province No. 4 AEON MALL Wuhan Jiangxia

Opened in November 2023

Hunan Province No.1 AEON MALL Changsha Xingsha

Scheduled to open in second half, 2024

Hunan Province No. 2 AEON MALL Changsha Xiang Jiang Xinqu

Scheduled to open in 2025

Securing New Properties in Vietnam

In December 2023, we signed new comprehensive memorandums of understanding on investment and business for shopping mall development in Vietnam with Can Tho City in the south and Bac Giang Province in the north.

In January 2024, we signed a memorandum of understanding with Viet Phat Group, a developer of shopping malls in Quang Ninh Province in the northern part of Vietnam. We added the central area (Da Nang City, Hue Province), Vietnam’s third largest economic zone, to our current southern area (Ho Chi Minh City, Binh Duong Province) and northern area (Hanoi City and Hai Phong City), accelerating area-dominant mall openings in surrounding cities. In the future, we intend to establish an even stronger foundation for business in Vietnam, expanding our businesses to regional cities to contribute to sustainable development and urban planning, which is experiencing remarkable economic growth.

Mutual cooperation agreements signed with Can Tho City and Bac Giang Province (December 2023)

Signed a cooperation agreement with Viet Phat Group, a development company in Quang Ninh Province (January 2024)

In the second half of 2024, we plan to open AEON MALL Hue, which will be our first mall in the central area of the country. Thua Thien Hue Province, where the mall will be located, has a population of 1.13 million, and Hue City has a population of 650,000, making the area one of promising economic development. The population is expected to continue to grow as the building of administrative facilities and residences are scheduled in the development area in the eastern part of Hue City.

AEON MALL Hue (scheduled to open in the second half of 2024)

Growth Initiatives(Priority Measures)

Growth Initiatives(Priority Measures)

Pursue Business Model Innovation in Japan

Leverage rapid change in the business environment as opportunities to reform existing business models to increase our capacity to attract customers and improve profitability

The external environment in Japan can be characterized by a declining population and labor shortages due to falling birthrates and aging demographics. In the internal environment, we see weakness in specialty store sales, particularly in the apparel industry, and high construction costs due to soaring materials prices. These factors represent significant issues that combine to reduce investment efficiencies. Taking advantage of dramatic and seemingly daily changes in the business environment, we strive to strengthen our ability to attract customers and improve profitability in Japan by introducing reforms into existing business models to respond to developing regional issues, customer values, and latent needs.

Maximizing the Appeal of Brick-and-Mortar Malls Through Customer Experience (CX)

As consumer behavior and purchasing habits change at an accelerating pace, AEON MALL strives to improve our ability to attract customers by creating customer experiences (CX, customer experiential value) and maximizing the appeal of brick-and-mortar malls. As customer needs for open and comfortable outside zones increase, we incorporate mechanisms to appeal to the five senses for comfort and ease, striving to create facility environments that will become a place of relaxation for our customers.

THE OUTLETS SHONAN HIRATSUKA (April 2023)

THE OUTLETS SHONAN HIRATSUKA makes the most of its open-air environment, with planted landscapes throughout and an open space with green terrace seating in the center of the facility, creating a comfortable environment in which visitors enjoy shopping while strolling through the park-like setting. The event court is equipped with a large LED vision system boasting a 300-inch screen. Artificial turf has been laid over the court, creating a space for relaxation, sports viewing, and other entertainment events, not to mention opportunities to eat and drink while watching the events.

Improve Profitability Through the Effective Use of Existing Assets

To use existing assets more effectively, we plan to create new business areas based on the utilization rate of shops and parking lots in our malls, converting underutilized space into new value. We analyze the issues for each region and each property, taking a precise approach once we have clarified the objectives and what value to provide.

Laketown OUTLET Expansion and Renovation (March 2024)

The renovated mall features a new two-story building and 64 international brand and lifestyle brand stores between the new and old buildings, including 34 new stores. A new bridge connects to the Kaze building, improving circulation throughout the facility.

HANYU noNIWA New Concept Facility (October 2023)

AEON MALL Hanyu built a new park in the area to the west the building, which had been used as a flat parking lot. The outside facility features a large outdoor goods specialty store (first entry in the northern Kanto region), as well as a plaza with lawn and fountain. The mall plans to build an outside sauna, glamping facilities, and velamping facilities to create more private spaces that enhance the functions of the facility.

Diversify Value Offerings Tailored to the Market

The direction of mall development in the future calls for market analysis from various perspectives, based on which we will build new mall models across a variety of development patterns according to the characteristics of the location in question. In this way, we will develop malls capable of proposing new value.

JIYUGAOKA de aone (October 2023)

Aiming for an environmental design that becomes a familiar part of the town of Jiyugaoka over time, we used an environmental design concept of urban, greenery, and walkable street space. A lush green terrace of 1,000 square meters will be located on the third floor as an outdoor space, offering a sense of openness and an area where local residents and visitors relax and gather.

Renovating Existing Malls to Attract More Customers and Improve Profitability

We continue to replace specialty stores and revitalize malls with new comfortable spaces and environments in common areas.

Playground for children using natural wood from the region

Furniture and plantings provide a sense of openness

AEON MALL Ota Expansion and Renovation (April 2024)

The mall features a new two-story building (West Mall). We also renovated the existing building, focusing on lifestyle-type specialty stores that support everyday living. The new Picnic Court is an area within the food court where customers can experience nature through all five senses, and represents just one way the mall has evolved into a community exchange hub, encouraging connections across generations.

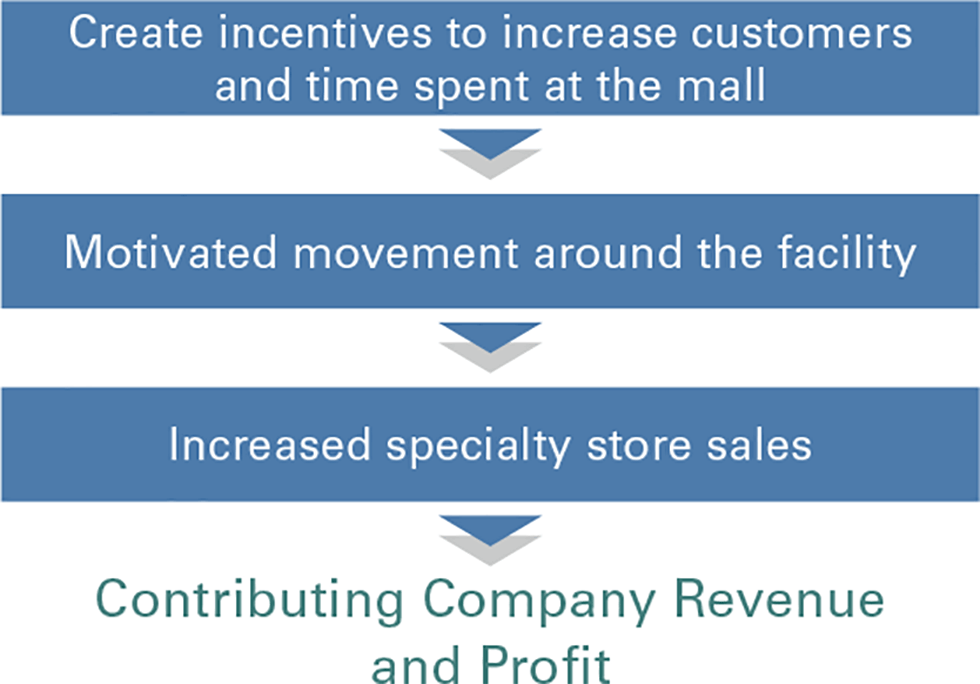

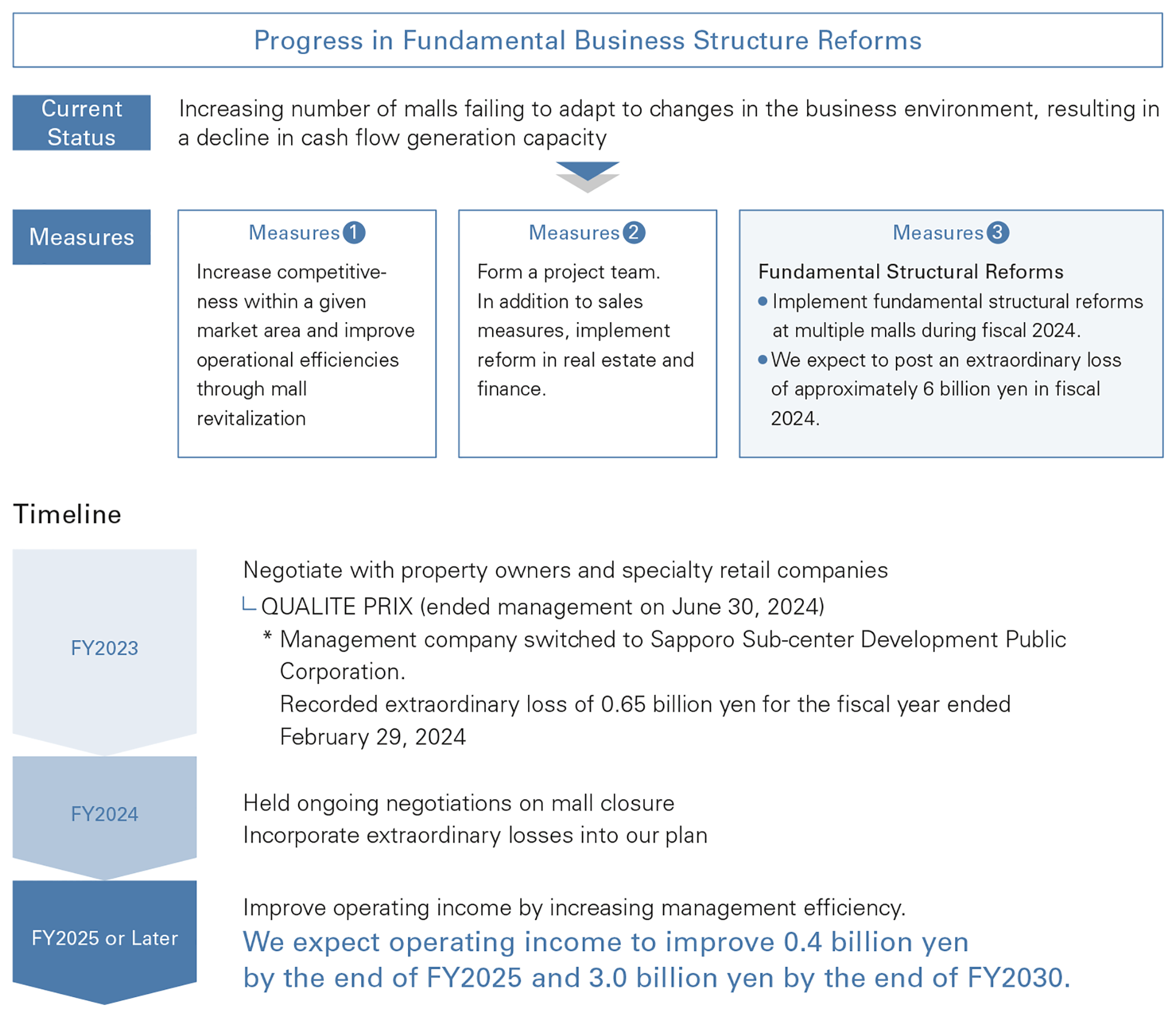

Implement Fundamental Business Structure Reforms

While we strive to deepen existing businesses amid accelerating changes in the external environment and in customer values, certain facilities have not responded to these changes sufficiently. The ability of these facilities to attract customers and generate cash flow has been in decline due to sluggish profitability. Create incentives to increase customers and time spent at the mall Motivated movement around the facility Increased specialty store sales Contributing Company Revenue and Profit We are engaged in increasing competitiveness and improving operational efficiencies within the market area, including investments in revitalization. In addition, we are also moving forward with initiatives aimed at fundamental structural reforms from the aspects of real estate and finances. By fiscal 2025, we intend to implement fundamental structural reforms at several malls. In fiscal 2024, we will record structural reform losses as an extraordinary loss of approximately ¥6 billion. Moving forward, we will implement fundamental business reforms designed to maximize future operating income.

Growth Initiatives(Priority Measures)

Growth Initiatives(Priority Measures)

Create New Business Models That Break From Existing Business Frameworks

Expand into new business domains by creating businesses that offer new value in an era of rapid and uncertain change

In an era of rapid and uncertain change, we not only develop existing businesses, but also focus on creating new businesses for new value and new initiatives, including broader complex development functions, to expand our business domains.

Expanding Complex Development Functions

To expand our office complex development capabilities, we aim to co-create the future of living in communities through stronger collaborations with partner companies via equity investments and business alliances. We believe we can contribute to sustainable urban reconstruction, which is the objective of the Japanese government’s Location Optimization Plan. We also believe we can be part of building vibrant and compact, networked cities by guiding urban functions that include residential functions, medical care, welfare, commerce, and public transportation to urban centers. Driven by this belief, we pursue redevelopment and mixed-use office complex development projects in urban areas, creating the future of community living.

Capital and Business Alliance With Marimo Co., Ltd. (March 2023)

This capital and business alliance focuses on multi-functional large-scale development, urban redevelopment projects, mixed-use development in urban areas, upgrading the use of AEON MALL assets, and investments in rural areas through the Marimo Rural Development REIT. Through this partnership, we aim to create vibrant communities and compact, networked cities.

Creating New Businesses Through Investments in Startup Companies

AEON MALL launched a corporate venture capital (CVC) arm through which we will invest in startup companies. The Life Design Fund brings together cutting-edge technology and expertise from startup companies for new value, helping us take on the challenge of creating new business value through solutions for local issues and the advancement of mall operations. We invested in COUNTERWORKS Inc., orosy Co., Ltd. and ATOMica Co., Ltd. through the Life Design Fund (operated in partnership with Ignition Point Venture Partners). We combine the mutual expertise of AEON MALL and investee companies to leverage effective company assets (malls) in providing spaces more integrated with local communities and achieving community co-creation.

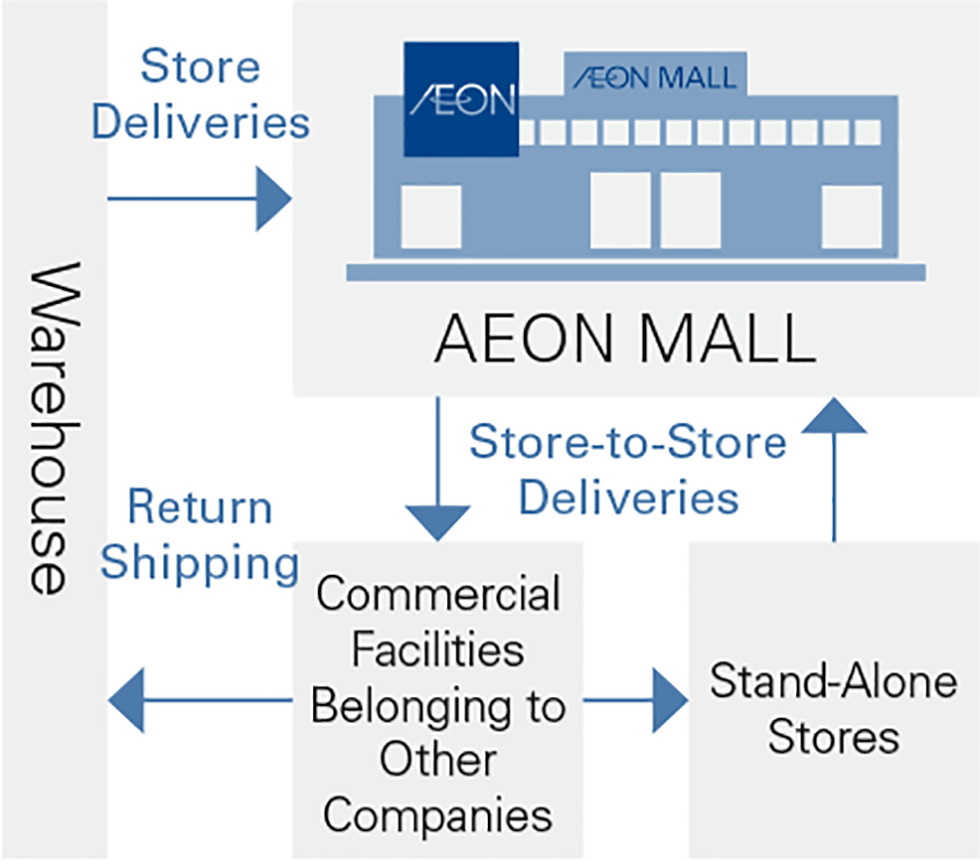

Develop Joint Delivery Services to Solve Logistics Issues

The joint delivery service takes deliveries from the logistics facilities of tenant companies to AEON MALL locations, other commercial facilities, street-facing stores, etc. The service will also handle inter-store deliveries and returns, helping tenant companies reduce costs and maintain quality in logistics services. In February 2023, we started providing services to the Kinki and Tokai areas. In response to requests from many companies, we expanded the service area to seven areas and 24 prefectures in December 2023. We plan to expand the delivery service area to include all of Japan in fiscal 2024. We look to play our part in building a sustainable logistics network, achieving both economic and environmental value through the common use of packing materials and hangers.

Foundation

Foundation

Build Strong Financial Foundations and Resilient Organizations From the Perspective of Sustainability

Strengthen our management foundation for sustainable growth toward truly integrated ESG management

Amid a dramatically changing business environment, build strong financial foundations and resilient organizations from the perspective of sustainability, supporting our pursuit of a regional shift in Japan and overseas and the creation of a Health and Wellness platform as we exercise truly integrated ESG management. In this way, we structure a strong management foundation capable of sustainable growth.

| Pursue a finance mix and optimize our asset portfolio |

|

|---|---|

| Strengthen management supervision function and establish a nimble business execution system |

|

| Leverage human capital,which is the most important management resource |

|

Sustainability Finance Initiatives

In November 2023, we formulated the Green Finance Framework to strengthen our efforts to achieve a decarbonized society and to truly integrated ESG management. We will use funds raised under the framework for new investments in qualified projects and the refinancing of existing ones. In addition to projects that focus on green buildings in Japan and overseas, for example, we are involved in creating local renewable energy for local consumption (”renewable energy,” below) by installing solar power generation facilities, purchasing CO2-free power sources derived from renewable energy, adopting EV charging and discharging facilities to build a renewable energy circulation platform with our customers, and the creation of biodiversity-conscious green spaces. We believe these initiatives are in line with the purpose of green finance and will have a positive impact on society.

Achieving Decarbonized Societies

As a decarbonization initiative, we will shift over time from procuring effectively CO2-free electricity through direct renewable energy contracts in each region to locally produced and locally consumed renewable energy (including PPA (see note below)). By fiscal 2040, we aim to operate 100% of our directly managed malls using locally produced and locally consumed renewable energy.

In January 2024, we signed an on-site solar PPA contract to install the largest all-inclusive solar carport in Japan. Solar Carports are attracting increasing attention as they provide improved convenience for parking lot users and renewable energy by using parking lot space effectively through carport installations of solar power generation systems. By fiscal 2025, we aim to expand the adoption of this system to more than 50 malls.

*1 PPA: Abbreviation for power purchase agreement (sales contract model). This is a business model in which a PPA operator leases space in a building premises or roof belonging to an electricity customer, installing a solar power generation system and selling the energy generated thereby to the customer.

Design with no pillars to avoid blocking auto movement. Both sun and rain protection for customers.

Diversity Management

AEON MALL respects human rights and is committed to diversity management that allows each individual, regardless of gender or nationality, to express their abilities fully, and we aim to secure higher levels of diversity within our organization. We formulate measures based on social changes surrounding work styles and feedback from surveys and employees. We discuss the progress of diversity-related initiatives with directors on a regular basis in the Management Conference and other meeting bodies.

In addition, we are taking steps to support the advancement of women, including the on-site AEON Yume-Mirai Nursery Schools, achieving 100% for the male employee paternity leave rate for three consecutive years, and increasing educational opportunities to foster motivation and career aspirations for women.

Our efforts have been recognized by third-party organizations. In 2023, AEON MALL was awarded the Platinum Eruboshi Certification, and in 2024 we were certified as a Health & Productivity Management Outstanding Organization for a fifth consecutive year.