To ESG Investors and Experts

Corporate Governance

Policies

Basic stance for corporate governance

AEON MALL is a Life Design Developer, creating the future of community living as we pursue our basic principle that the customer comes first. Life Design extends beyond the framework of the shopping mall. Life Design extends beyond the framework of the shopping mall. Life Design addresses functions associated with different customer life stages, including not only shopping, but also interaction with other people, cultural development, and other features contributing to future lifestyles.

AEON MALL strives to localize our malls to the characteristics of each community we serve. In this way, we contribute to better lifestyles and local community growth. In addition, by continuing to provide solutions to regional and social issues through pro-moting growth measures in our long-term vision and medium-term management plan, we will establish ourselves as a core facility in local communities, providing a social infrastructure function. In order to accomplish this, we recognize that governance is a matter of utmost important in management and will work continually to improve our corporate governance.

Corporate governance structure guidelines

- We provide a consistent and fair environment to support shareholder rights and the execution of said rights. We work in cooperation with shareholders toward the goal of sustainable growth.

- Our board of directors and senior management respect the rights and perspectives of customers, local communities, partner companies, employees, shareholders, investors, and other stakeholders, conduct business activities ethically, and demonstrate leadership in fostering corporate culture and climate and proactively taking actions toward sustainability.

- We have created a Disclosure Policy and Rules for Managing Information Disclosure to address disclosure of financial and nonfinancial information. Guided by these policies, we ensure transparency and fairness through appropriate and clear information disclosure.

- The board of directors consists of individuals with a diverse range of experience and expertise, helping us capitalize on our strengths as a developer with roots in the retail business. We appoint independent outside directors to strengthen our supervisory system and conduct highly transparent business. Our board of directors determines important corporate strategies and measures to achieve our long-term vision and medium- and long-term plans.

- We incorporate feedback and input received through constructive dialogue with shareholders to improve our corporate value.

The Aeon Mall policy on cross-shareholding is to hold shares for the purpose of contributing to improved Aeon Mall Group corporate value over the medium and long term. This policy considers a number of factors including business strategy and business relationships.

We review individual cross shareholdings on an annual basis, considering the purpose for holding shares, whether share dividend income exceeds the cost of capital, risks involved in holding shares, and transactions with the issuing party. These factors are part of determining the overall benefits of holding shares for the long-term. This annual review is conducted by the board of directors, the final determination of which we disclose publicly.

When exercising voting rights of cross-held shares, we verify whether each proposal contributes to the medium- and long-term improvement in Aeon Mall corporate value and whether said proposal holds the potential to damage our corporate value. As necessary, we hold discussions with the issuing company as part of our overall decision-making process.

AEON MALL has established a system to ensure transactions with officers or major shareholders (related-party transactions) do not infringe on the interests of the company or our shareholders.

Basic stance for related-party transactions

- In deliberations at the board of directors, we carefully investigate whether competitive transactions by directors and transactions involving conflicts of interest with directors and AEON MALL infringe on the interests of AEON MALL or our shareholders. Our investigations include consulting with experts regarding the reasonable nature of the transactions in question, and include pre-deliberations by the Governance Committee (tentative name), which consists of outside directors. We ensure fairness in this process through a number of means, including recusing directors having special interests in transactions with AEON MALL from voting in the resolution.

- When we enter into transactions with related parties, we clarify the identity of such parties in our Related Party List according to the provisions of our Rules for Managing Related Party Transactions. We ensure objectivity in transaction terms through rules that include providing comparison tables in period-end financial reports that show examples of transactions with non-related parties. According to the importance and nature of the transaction in question, we comply with our Authority Rules in soliciting opinions from outside directors and members of the Audit and Supervisory Board during board of director meetings regarding the rationality (business purpose) and reasonable nature of the transaction terms. On an annual basis, we investigate the rationality and reasonableness of transactions, issuing a report on the annual increase or decrease in transactions with related-party companies.

AEON MALL belongs to a corporate group consisting of AEON Co., Ltd. (pure holding company) and AEON Co., Ltd. consolidated subsidiaries and equity-method affiliates. The AEON Group provides comprehensive financial, development, services, and other businesses focusing on retail in the GMS sector. AEON MALL is a core group company responsible for the development business.

AEON Co., Ltd. is responsible for developing group strategy, allocating group management resources optimally, overseeing and instilling group management philosophies and basic principles, and providing shared group services to maximize group synergies. At the same time, AEON MALL and other group companies strive to become more skilled in our respective specialties and engage community-focused business to reach new levels of customer satisfaction.

AEON MALL leverages the more than ¥8 trillion in group revenues to increase customer drawing power, using the AEON Group infrastructure, including the AEON Card and the WAON electronic money service, to conduct marketing promotions.

AEON Co., Ltd. and affiliates hold 58.8% (58.2% direct holdings) of AEON MALL voting rights as of February 2021. However, AEON MALL makes independent management decisions regarding day-to-day business operations. AEON MALL consults with our reports to AEON Co., Ltd. regarding important issues. AEON MALL maintains a close and cooperative relationship with AEON Co., Ltd. and other group companies, embracing a mutual respect for self-reliance and independence as we collectively strive for sustainable growth, development, and improved earnings.

Commitment to gender diversity

The company’s articl es of incorporation allow for a maximum 20 directors to ensure active discussions and nimble decision-making in board meetings. Of our 13 directors today, five are outside directors who provide independence and objectivity (as of May 20, 2021). Internal directors have an understanding of our overall business operations, a sense of balance, a history of achievements, and decision-making skills, contributing to the diversity of expertise among board members. Outside directors consist of independent individuals with management experience and expertise in a variety of industries, contributing a diversity of viewpoints, a wealth of experience, a depth of knowledge, and expert opinions. As a developer, manager other operator of shopping malls, AEON MALL seeks the values and conceptual ideas of women. Accordingly, we pursue diversity in management, including appointing women as constituent members of our board of directors. The Company employs a diverse workforce without regard to nationality, race, gender, age, educational background, religion other. The president and CEO proposes director candidates according to the following criteria. The Nomination and Compensation Committee hears opinions from independent directors, and then presents their findings to the board of directors as agenda items for the general meeting of shareholders. The board makes the necessary resolutions which are submitted to the general meeting of shareholders for approval.

Management

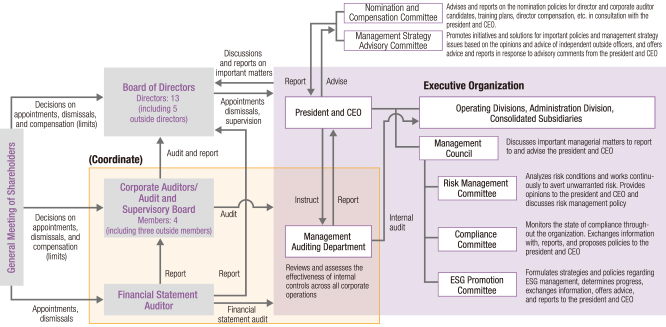

Corporate governance structure

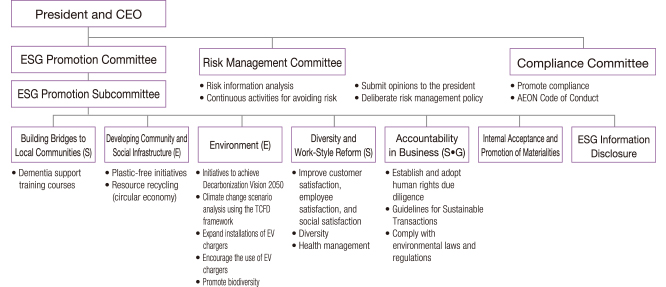

AEON MALL established the Management Council to serve as an advisory body for the president and CEO. This council consists mainly of managing directors and higher, full-time members of the Audit and Supervisory Board, and individuals appointed by the president and CEO. The purpose of this council is to strengthen business strategy functions and ensure a more efficient decision-making process. We bolster management and supervisory functions by holding at least one meeting of the board of directors per month, chaired by the president and CEO.

In addition to these mechanisms, we strive to disseminate information through committees led by general managers or other managers below the rank of representative director. The purpose of these committees is to ensure efficient business activities. AEON MALL has adopted a corporate auditor system led by outside members of the Audit and Supervisory Board. The board works in coordination with outside financial statement auditors and the Management Auditing Department as part of a structure ensuring a sufficient audit function. Each member of the Audit and Supervisory Board attends board of director meetings, while full-time members of the Audit and Supervisory Board are always present at meetings of the Management Council.

Managing board of director meetings

In addition to holding regular board of director meetings monthly, the Company convenes extraordinary meetings of the board of directors as deemed necessary. Decisions encompassing substantial risk threatening far-reaching impact on the Group are brought to the Management Council for discussion. These decisions are then approved by the CEO and/or by resolution of the board of directors. Executive authority and responsibility is clearly defined according to each of the Rules for Organization Management, Rules for Segregation of Duties, Rules of Jurisdiction, Rules for Approval Requests, and Rules for Management of Affiliates.

Director dismissal and dismissal criteria

The president and CEO proposes director candidates according to the following criteria. The Nomination and Compensation Committee, which consists mainly of outside directors, discusses nominations, which are then presented to the board of directors as agenda items for the general meeting of shareholders. The board makes the necessary resolutions which are submitted to the general meeting of shareholders for approval.

- Internal directors must have the ability, knowledge, experience, and achievements required for their field of specialization. These individuals must also have a sense of balance and judgment that enables them to understand and act across all aspects of business operations.

- Outside directors must have abundant experience and insight in professional specialization. These individuals must have sufficient time to carry out their duties as company directors and possess qualities to provide independent advice and recommendations on the appropriateness of decision-making by the board of directors.

- Candidates must be aware of business issues based on experience in general business management

- Candidates must have no interests or business relationships that may affect their execution of duties as a member of the Audit and Supervisory Board

- Candidates must have considerable knowledge of finance and accounting, or skills, expertise, and experience in a specialized field. Accordingly, the majority of the members of the Audit and Supervisory Board possess financial expertise and skills.

- The Company rotates assignments for members of the Audit and Supervisory Board to maintain appropriate audit functions.

The appointment and dismissal of the CEO of the Company are decided by a resolution of the board of directors. The determination as to whether or not the selected person has the necessary qualifications, evaluation and experience for the position of CEO is part of a highly transparent and fair procedure, discussed by the Nomination and Compensation Committee, which consists mainly of independent officers. This committee's discussions are followed by deliberations at the board of directors, which is a highly transparent and fair procedure. A candidate for CEO must have an appropriate breadth of experience, insight, and advanced expertise. The CEO must also have managerial ability and leadership skills sufficient to achieve continuous growth in the company’s business.

| Classification | Name | Board of directors (FY2020) Attendance/No. of meetings |

Audit and supervisory board (FY2020) Attendance/No. of meetings |

|

|---|---|---|---|---|

| President and CEO | Yasutsugu Iwamura | General Manager, Overseas Business | 16/16 | — |

| Senior Managing Director | Mitsuhiro Fujiki | Executive General Manager of CX Creation Division | 16/16 | — |

| Managing Director | Hisayuki Sato | General Manager of Development Division | 16/16 | — |

| Managing Director | Masahiko Okamoto | General Manager of Administration Division | 16/16 | — |

| Managing Director | Hiroshi Yokoyama | General Manager of Finance & Accounting Division | 16/16 | — |

| Director and Advisor | Motoya Okada | 16/16 | — | |

| Directors | Akiko Nakarai | Executive Manager of Marketing Management Department | 16/16 | — |

| Directors | Tatsuya Hashimoto | China Business Manager | 12/12*5 | — |

| Outside Members of the Board of Directors | Masao Kawabata*1 | 12/12*5 | — | |

| Outside Members of the Board of Directors | Kunihiro Koshizuka*2 | 12/12*5 | — | |

| Outside Members of the Board of Directors | Yasuko Yamashita*2 | 12/12*5 | — | |

| Outside Members of the Board of Directors | Hironobu Kurosaki*2*6 | — | — | |

| Outside Members of the Board of Directors | Junko Owada*2*6 | — | — | |

| Outside Members of the Board of Directors | Chisa Enomoto*2*6 | — | — | |

| Members of the Audit and Supervisory Board | Maki Watanabe*3 | 16/16 | 14/14 | |

| Members of the Audit and Supervisory Board | Takao Muramatsu*2*3 | 15/16 | 13/14 | |

| Members of the Audit and Supervisory Board | Emi Torii*2*3 | 16/16 | 14/14 | |

| Members of the Audit and Supervisory Board | Masato Nishimatsu | 12/12*5 | 11/11*5 |

*2 Mr. Kunihiro Koshizuka, Ms. Yasuko Yamashita, Mr. Hironobu Kurosaki, Ms. Junko Owada, and Ms. Chisa Enomoto are outside directors, as well as independent directors as defined by the Tokyo Stock Exchange.

*3 Ms. Maki Watanabe, Mr. Takao Muramatsu, and Ms. Emi Torii are outside members of the Audit and Supervisory Board.

*4 Mr. Takao Muramatsu and Ms. Emi Torii are independent directors as defined by the Tokyo Stock Exchange.

*5 A total of 12 board of directors meetings were held since being elected as an outside director of the Company at the 109th Ordinary General Meeting of Shareholders held May 19, 2020. Assumed said office as of the same date.

*6 Elected as an outside director of the Company at the Ordinary General Meeting of Shareholders held May 20, 2021. Assumed said office as of the same date.

Number of other committee meetings

In fiscal 2020, the Risk Management Committee met four times, and the Nomination and Compensation Committee met seven times.

Evaluating board of director effectiveness

To ensure effective and strong corporate governance, the company verifies the degree to which directors contribute to the board of directors, identifying issues and implementing improvements. The Company conducts an analysis and evaluation of the entire board of directors on a regular basis (once per year).

The company’s board of directors fill out a self-assessment survey related to board effectiveness. Survey responses are analyzed by third-party entity, while outside directors lead discussions and exchange opinions. The board of directors then reviews and discusses the analysis and evaluation.

Board of director meetings function appropriately. Board meetings follow proper agendas and allow sufficient time for active discussions among directors and corporate auditors who have a diverse background of opinions and experiences.

AEON MALL strives to enhance the quality of deliberations conducted by the board of directors and the board’s effectiveness by working to improve global governance and risk management to support appropriate risk-taking as we expand the scale of our overseas operations. Moreover, the company implements measures to improve the functions of the board of directors.

Officer remuneration, etc.

The company has established a policy regarding determinations and calculation methods of remuneration amounts, etc., for directors, the details of which are as follows.

- Director remuneration provides strong motivation to carry out management policies, is linked to business performance, and is designed to ensure objectivity and transparency.

- Director remuneration consists of basic remuneration, Performance-based remuneration, and stock options.

- (1) Basic remuneration

Basic remuneration is paid on a monthly basis, as determined by individual evaluation and within the standard amount established for each title. - (2) Performance-based remuneration

Performance-based remuneration is weighted at approximately 30% of total cash remuneration (basic remuneration plus Performance-based remuneration), weighted according to individual responsibility.

Performance-based remuneration paid to each director (individual basis) is calculated according to performance-linked amount and performance-linked payout ratio, reflecting a payout ratio based on corporate earnings (0% to 170%) and an evaluation of individual performance. We have selected budget-to-actual for ordinary income as the most appropriate indicator of normal business performance for the company.

Evaluations of individual director performance are conducted by independent outside directors serving as members of the Nomination and Compensation Committee, based on an annual performance report of the individual director in question. These evaluations finalized after an additional evaluation by the president of the company. The president of the company provides the final results of director evaluations and performance-linked payout ratios to the independent outside directors. - (3) Stock options

Our aim is to increase the motivation and morale toward medium- and long-term sustained earnings and corporate value improvement through the allocation of stock acquisition rights as stock options reflecting corporate earnings. We accomplish this by strengthening the relationship between share prices, earnings, and compensation, ensuring directors share the same benefits of share price increases and risk of share price decreases with shareholders. The number of stock acquisition rights allocated is determined based on the performance of the relevant year and a numerical factor based on title. If ordinary income for the grant year is less than 80% of budget, half of planned options will be granted. If the company records a net ordinary loss for the grant year, no options will be granted. - Outside directors are paid a fixed compensation only. Company earnings and individual performance evaluations are not considered as part of this compensation.

- The remuneration limit for directors was limited to a maximum ¥600 million per fiscal year as approved at the 96th regular meeting of general shareholders, held May 17, 2007. The company had a total of 20 directors serving at the time of the resolution.

- The company’s president and Chief Executive Officer is the individual with the authority to determine policies related to director remuneration amounts and calculation methods. The particulars of this authority and scope of discretion relates to individual remuneration amounts (cash portion) for each director. At a meeting held in November 2018, the board of directors resolved to establish the Nomination and Compensation Committee, which began operating in January 2019. The Nomination and Compensation Committee consists of five independent outside directors (as of February 28, 2021) who conduct deliberations, and advising and reporting to the president and chief executive officer of the company. After committee consultations and reporting, the president and chief executive officer determines Performance-based remuneration based on corporate earnings and individual director performance, subject to the scope set in place.

- Given their independent position in supervising the execution of duties by directors, members of the Audit & Supervisory Committee are paid only fixed compensation. This level of remuneration is necessary to ensure the appropriate people play a central role in establishing and operating high-quality corporate governance. The remuneration limit for directors was limited to a maximum ¥50 million per fiscal year as approved at the 91st regular meeting of general shareholders, held May 8, 2002, finalized subsequent to negotiations with the members of the Audit and Supervisory Board. The company had a total of four members of the Audit and Supervisory Board serving at the time of the resolution.

The following outlines policies related to remuneration of members of the Audit and Supervisory Board:- (1) Basic remuneration

The company pays a fixed amount according to the experience, insight, and title of each member of the Audit and Supervisory Board. - (2) Performance-based remuneration

The company does not offer Performance-based remuneration to members of the Audit and Supervisory Board. - (3) Stock options

The company does not offer stock options to members of the Audit and Supervisory Board.

- (1) Basic remuneration

| Title | Director remuneration composition | Total | ||

|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | |||

| Performance-based remuneration | Medium- and long-term incentive stock options | |||

| Executive directors | 61% – 69% | 22% – 30% | 9% | 100% |

| Directors | 68% – 72% | 22% – 25% | 6% – 7% | |

| Outside members of the board of directors | 100% | 0% | 0% | |

- This table represents 100% achievement of targets related to Performance-based remuneration. The ratios above will change according to changes in company earnings performance, share price fluctuations, etc.

- Different compensation tables are applied depending on director role and grade. Therefore, ratio of compensation by type may differ for individuals, even those who have the same title.

The AEON MALL board of directors made the following deliberations and decisions related to director remuneration during the current fiscal year:

- April 13, 2020: Decision regarding performance-linked remuneration for directors

- April 13, 2020: Issuance of stock acquisition rights as 13th Performance-Linked Stock Options

- April 13, 2020: Allocation of stock acquisition rights as 13th Performance-Linked Stock Options

- May 19, 2020: Decision regarding basic compensation for directors for fiscal 2020

The Nomination and Compensation Committee serves as an advisory organ to the president and chief executive officer. The committee deliberates, exchanges opinions, and provides advice and reports to the president of the company regarding the propriety of basic remuneration and Performance-based remuneration paid to directors, as well as the validity of performance evaluations of said directors.

- March 3, 2020: Matters related to the evaluation of individual executive director performance

- April 9, 2020: Report on matters related to individual director performance evaluation results and performance-linked compensation payout ratios

- July 21, 2020: Selection of a chairperson, matters related to the scope and composition of directors, and matters related to effectiveness evaluations of the board of directors

- September 23, 2020: Matters related to the scope and composition of directors

- November 19, 2020: Matters related to the scope and composition of directors, and matters related to effectiveness evaluations of the board of directors

- December 22, 2020: Matters related to effectiveness evaluations of the board of directors

- January 20, 2021: Matters related to effectiveness evaluations of the board of directors, candidates for outside directors, and director structure for the next fiscal year

| Director title | Total amount of remuneration (million yen) | Total amount of remuneration by type (million yen) | Eligible directors (persons) | ||

|---|---|---|---|---|---|

| Basic remuneration | Stock options | Estimated director bonuses | |||

| Directors (excluding outside directors) | 216 | 168 | 24 | 22 | 12 |

| Audit and Supervisory Board members (excluding outside members) | — | — | — | — | — |

| Outside directors | 43 | 43 | — | — | 7 |

Not provided, as no individual is paid total consolidated remuneration of more than ¥100 million.

Not applicable.