To ESG Investors and Experts

Climate Change

Policy

TCFD

Based on the Aeon Decarbonization Vision 2050, AEON aims to reduce total CO₂ and other emissions in Japan to zero by 2040. In line with the AEON MALL Group Vision, AEON MALL has set a goal to reduce energy consumption by 50% in fiscal 2020 compared to fiscal 2010, the AEON MALL Group has streamlined air conditioning operations, introduced high-efficiency and energy-saving equipment, installed solar systems on mall rooftops and walls, implemented LED lighting, and more. As a result, we have achieved a 55.1% reduction in energy consumption (per unit of floor space) over the aforementioned target period. In addition to these reduction measures, we have announced that we will operate all AEON MALL locations (large-scale commercial facilities) in Japan with effectively CO₂-free electricity in fiscal 2025 by newly procuring electricity from off-site renewable energy generation and promoting direct renewable energy contracts in each region.

In June 2020, we declared our support for the Task Force on Climate-related Financial Disclosures (TCFD), a task force for information disclosure of business risks and opportunities posed by climate change. The TCFD was established in 2016 by the Financial Stability Board (FSB), an international organization that seeks to stabilize the financial system. This section introduces our efforts to address climate change in line with the information disclosure framework recommended by TCFD

Climate change policy

Combined, AEON Group stores account for close to 1% of Japan’s total electricity consumption. Therefore, we recognize how important it is to find ways to use energy more efficiently and reduce our impact on the environment. This is what led the AEON Group to adopt the Aeon Manifesto on the Prevention of Global Warming in 2008 and the AEON Eco Project in 2012. In these ways and others, the group strives to reduce energy consumption and CO₂ emissions.

We took up a new challenge in March 2018 when we announced AEON Decarbonization Vision 2050. This vision calls on us to help achieve a decarbonized society by 2040 through further energy conservation, renewable energy, etc..

AEON Decarbonization Vision 2050

AEON will work to reduce CO₂ and other greenhouse gas (hereinafter “GHG”) emissions by taking the following three-pronged approach, thereby contributing to the realization of a decarbonized society.

- We will reduce the total GHG emissions from our stores to zero by 2040.

- We will continue our efforts to achieve zero GHG emissions from our business operations.

- We will cooperate with our customers for the realization of a decarbonized society.

Energy use policy

- AEON Eco Project: Reduce energy usage by 50% in fiscal 2020 compared with fiscal 2010.

* Achieved actual reduction of 55.1%. - We will conduct day-to-day equipment operations in energy-efficient ways.

- We will adopt LED lighting, energy conservation systems, plug-in hybrid vehicles (PHV), and electric vehicles (EV).

- We will promote the use of PHVs and EVs as part of the regional infrastructure.

Participation in climate change initiatives

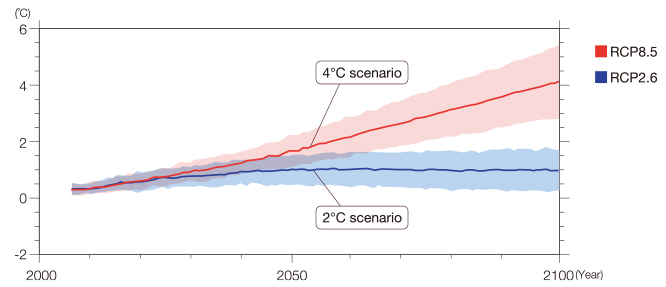

The Paris Agreement, which aims for zero greenhouse gas emissions, was adopted at COP21 (the 21st Conference of the Parties to the United Nations Framework Convention on Climate Change). Meanwhile, Japan has also announced a target greenhouse gas reduction of 46% in 2030 versus 2013 levels. In June 2020, we declared our support for the Task Force on Climate-related Financial Disclosures (TCFD), which focuses on the business risks and opportunities posed by climate change. For our analysis, we selected the 2°C scenario and the 4°C scenario, with reference to the climate change scenarios presented in the Fifth Assessment Report of the United Nations Intergovernmental Panel on Climate Change (IPCC). The time axis of the analysis indicates the impact of climate change by 2050. We conduct scenario analysis based on these assumptions in order to estimate this impact.

In 2017, we became the first Japanese company to participate in EV100*.

As one measure to preserve the global environment and create sustainable societies, we are installing electric vehicle (EV) recharging stations at our malls to encourage the use of low-CO₂ electric vehicles and plug-in hybrids.

* EV100:An international business initiative for the corporate promotion of the use of electric vehicles and environmental improvement.

Established in July 2018 as a network to communicate information and encourage the exchange of opinions among companies, local governments, and NGOs that are working actively to combat climate change. AEON Mall participates in this initiative.

Board of Directors Role (Environment)

Deliberations by the ESG Promotion Committee and its subcommittees, the Risk Management Committee, and the Compliance Committee are reported to the board of directors. Additionally, climate-related issues are also incorporated into the annual board of directors’ agenda. The board then makes further connections between climate-related issues and the business, and acts in a supervisory capacity to ensure that there are no errors.

Every year, as part of our ISO environmental goals, we set company-wide energy-saving targets. Each mall plans, implements, and manages progress for energy-saving initiatives. If any of these business units fail to achieve these targets, it will examine corrective measures, and submits a report to environmental departments. Particularly important corrections are reported to the ESG Promotion Committee and Subcommittee or, for highly urgent matters, to the Management Council and the Board of Directors.

Management Role (Environment)

The role of management in environmental issues is to make decisions on specific measures related to the environment, including achieving the AEON Decarbonization Vision 2050. The risks and opportunities from climate change have a major impact on business strategy, so the ultimate responsibility for these rests with the president and chief executive officer.

The ESG Promotion Committee, a forum for discussions on sustainability, has been established as a subordinate mechanism under the Management Council. The ESG Promotion Committee is chaired by the president and chief executive officer, and consists of directors and full-time Audit & Supervisory Board members. In addition to its day-to-day efforts, the committee meets every two months to discuss company internal and external needs and expectations as well as current issues and problems, set targets for initiatives, and manage progress, with a focus on the four areas of environmental issues, social issues, governance, and communication, aiming for rapid resolution of issues.

In addition, the ESG Promotion Committee addresses not only agenda items on management issues and ESG targets, but also rapidly makes decisions on specific measures aiming to achieve the AEON Decarbonization Vision 2050 — these include promoting the use of renewable energy and adding more EV chargers.

Strategy

Selection of Climate Change Scenario

In reference to the climate change scenarios in the United Nations Intergovernmental Panel on Climate Change (IPCC) Fifth Assessment Report, we selected the 2°C scenario and the 4°C scenario. The time axis of the analysis indicates the impact of climate change by 2050 towards achieving the goals set forth in the AEON Decarbonization Vision 2050. We are carrying out a scenario analysis based upon these assumptions, and estimating the impact of climate change.

If we do not take measures in addition to those currently taken, an increase in 3.2°C to 5.4°C compared to the industrial revolution

If we take strict measures, an increase in 0.9°C to 2.3°C compared to the industrial revolution

*Source: The Fifth Assessment Report (AR5) of the Intergovernmental Panel on Climate Change (IPCC)

Identify risks and

opportunities

- Collect information on risks and opportunities in the real estate sector

- Identify transition and physical risks and opportunities that may occur in the company from the perspectives of policy and market, etc.

Evaluate importance

- Qualitatively assess identified risks and opportunities, and evaluate their importance with a categorization of their impact on the company into large, medium, and small

Estimate impact

- Quantitatively analyze the impact posed to business of significant risks and opportunities using high-reliability external projections and our own figures

Explore measures

- Consider response methods for climate change risks and opportunities with a particular impact on business

- Establish a promotion system as necessary

Implemented

Implementation planned

Major risks and opportunities

AEON MALL has summarized the significant climate change risks and opportunities in Japan, China, and ASEAN countries in which we operate our mall business based upon external information, and has collected forward-looking forecast data on each of these risks and opportunities. Using this, we have studied the risks and opportunities involved with the transition to a decarbonized society, as well as the physical risks and opportunities stemming from climate change. We have identified the primary risks and opportunities that may impact our business by 2050.

One example is a hypothetical situation which sees the widespread adoption of electric vehicles. In this, we have identified a risk in which delays in investment in charging stations may limit our ability to attract customers, countered by the opportunity in which appropriate capital investment will differentiate us from competitors and positively impact our ability to attract customers. We also identified the risk of flooding and power outages within and outside our facilities due to torrential rains and typhoons because of increasingly extreme weather events. However, the installation of watertight panels to prevent flooding and other tangible and intangible disaster preparedness measures may give us a competitive advantage, and by extension increased opportunities for our business partners to use the facilities and better attract customers. Please refer to the table for details.

| Evaluated item | Consideration of impact on business (risk) | Consideration of impact on business (opportunity) | Impact | Time | ||

|---|---|---|---|---|---|---|

| Main category | Sub-category | |||||

| Transition | Policy/regulatory | Carbon tax, greenhouse gas emissions regulations | Increases in petroleum and coal taxes are expected to increase procurement costs for construction materials, as well as costs for fuels used in operating facilities. The promotion of policies in line with the Paris Agreement will make thorough energy-saving measures necessary. | Upon reaching zero greenhouse gas emissions, the carbon tax will no longer apply. The transition to energy-saving and renewable energy construction together with low-carbon construction materials may increase market value. | High | Long term |

| Subsidy policies for renewable energy | The end of FIT-based purchasing will reduce income from sales of power from existing renewable energy facilities. | There is the possibility of being able to use new subsidies. There is also the possibility of accessing new markets such as in trading of renewable energy certificates. | Low | Short-medium term | ||

| Industry/market | Changes in customer behavior | Increasingly efficient specialty stores will need to differentiate themselves from other companies in regards to their buildings’ environmental performance. | Providing high-efficiency buildings as a response to heightened interest in energy efficiency will provide differentiation with competitors, and lead to higher rents for specialty stores. | High | Short-long term | |

| Changes in energy mix and demand | Constrained demand for energy will increase electricity procurement costs, leading to an increase in operating costs from utility bills. Higher demand for the procurement of renewable energy will increase its cost, increasing the financial burden. | The move to low-carbon grid electricity will limit the requirement to pay carbon taxes and invest in energy-saving facilities incurred from building construction and operation of facilities. | High | Medium term | ||

| Technology | Spread of electric vehicles | The spread of EVs will require the installation of charging facilities at our operating facilities, meaning increased capital investment costs. A failure to respond to this will lower our ability to attract customers. | Having charging facilities at operating facilities will help with differentiation from competing facilities, and will positively impact the ability to attract customers. | High | Medium term | |

| Spread of renewable energy and energy-saving technologies | The degree of response to technical innovations such as building performance and environmental friendliness of used services will impact competitiveness with other companies. | The introduction of energy-savings/renewable energy technologies will reduce operating costs and increase property values. | Medium | Medium term | ||

| Reputational | Change in reputation from customers | In the event of inadequate disclosure of climate change initiatives and non-financial information, this may lead to a decline in our corporate reputation amongst specialty stores and the general public, with a possible decrease in rent revenue from specialty stores. | (Not applicable) | Low | Short-long term | |

| Change in reputation from investors | Inadequate disclosure of climate change initiatives and of non-financial information may result in a decline in our corporate reputation from investors, leading to unfavorable loan rates. | Issuing green bonds or similar may attract new funds from the investor community that places value upon responsible investment. | Low | Short-long term | ||

| Physical | Chronic | Rise in average temperatures | The increase in very hot days will require measures such as an increase in insulation and air conditioning to ensure a comfortable interior environment during summer, which will increase construction costs. Cooling loads will increase due to higher temperatures, meaning higher operating costs. | Installing high-efficiency insulation and air-conditioning equipment in these operating facilities will help keep summer air-conditioning costs down, providing a competitive advantage in terms of operating costs. Creating a comfortable space for mall users, including employees of specialty stores, will lead to increased customer numbers and higher specialty store employee satisfaction. | Medium | Long term |

| Rise in sea levels | It is possible that facilities in coastal locations may incur costs for measures to deal with rising sea levels. Locations of high risk will also face increased insurance premiums. | (Not applicable) | Medium | Long term | ||

| Change in rainfall and weather patterns | Increased deterioration of building materials because of storms and solar UV will require the development of lower cost and more durable material technologies. Damage to properties may impact operations, and lead to lower revenue. | (Not applicable) | Low | Medium-long term | ||

| Acute | Increasingly extreme weather phenomena | Torrential rains and typhoons will cause flooding inside and outside facilities as well as power outages requiring remedial measures and costs, which will mean fewer business days and customers. Insurance premiums will also increase to cover storm and flood damage. | Gain a competitive advantage by promoting the enhanced tangible and intangible disaster preparedness of our managed facilities, thereby leading to increased rental income along with more customer usage of our facilities and an improved reputation. | High | Short-long term | |

Risks and Opportunities

Towards Achieving a Decarbonized Society

AEON MALL aims to help create decarbonized societies by the year 2040. To this end, the Company carried out a scenario analysis as a commercial developer with regard to climate change for the purpose of achieving decarbonized societies. Results of our analysis showed that on top of transition risks from the addition of a carbon tax to achieve decarbonization and other climate change-related trend changes, physical risks such as rising sea levels and abnormal weather patterns because of global climate change would also have a significant impact on the AEON MALL. In order to construct a resilient infrastructure system, in light of the recent torrential rains in western Japan and Typhoon No. 24, which caused extensive damage from floods and tornadoes both in Japan and overseas, we have included floods and tornadoes as new risks. Also, based on the responses of individual malls to previous disasters, we have established a range of policies such as our natural disaster response guidelines. As we continue with scenario analyses, we will carry out not only qualitative assessments, but also quantitative impact assessments so that we can understand the financial impacts of climate change.

By the Year 2025, all AEON MALL Facilities Will Transition to Renewable Energy

In 2018, AEON formulated the AEON Decarbonization Vision 2050, aiming to achieve a decarbonized society by the year 2040 through the pursuit of energy conservation and the use of renewable energy, etc. In line with the AEON MALL Group Vision, AEON MALL aims to operate all malls using renewable energy by 2025.

In addition, AEON MALL Kawaguchi (Saitama Prefecture), which opened in June 2021, is successfully operating with virtually zero electricity and gas CO₂ emissions. In addition to energy-saving efforts, the mall procures electricity with virtually zero CO₂ emissions through the non-FIT non-fossil certificate electric power program*1 offered by TEPCO Energy Partner, Inc. The mall also sources carbon neutral city gas*2 supplied by Tokyo Gas Co., Ltd.

Risk Management

The AEON MALL defines all risks, including fluctuations in sales due to competition, fluctuations in exchange rate, reputational damage, as well as earthquakes and fires. We have elucidated our basic approach to managing these in the Risk Management Rules. Depending on the nature and type of risk, these will be handled by different departments, and categorized as the Management Strategy Division, the Compliance Committee, and the Risk Management Committee. This Risk Management Committee's objective is to stay abreast of the status of risk management operations, to exchange information, and to continuously review the risk management system. The committee also makes reports and proposes policies to the representative director and president with regard to risk management.

We also include climate change risk in our regular risk survey, identifying and managing highly important climate change risks.

The ESG Promotion Committee calls internal officers to meet six times a year. The committee discusses climate change risks, while particularly important risks are managed and assessed by the Management Council and the board of directors.

Energy use monitoring system

Each year, AEON MALL sets group-wide energy conservation targets within our ISO environmental targets. Each mall then plans and carries out its own energy conservation initiatives and manages progress. Malls that do not meet their target examine corrective measures and submit a report to environmental personnel. Particularly important corrections are reported to the ESG Promotion Committee and Subcommittee or, for highly urgent matters, to the Management Council and the Board of Directors.

Indicators and targets

Energy consumption

| Unit | Scope*1 | Boundary | FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | |

|---|---|---|---|---|---|---|---|---|

| Energy consumption (crude oil equivalent) | kl | ① | Common space | 117,278 | 118,030 | 118,723 | 117,801 | 112,922 |

| Energy consumption intensity | GJ/1,000㎡×h | ① | Common space | 0.432 | 0.410 | 0.401 | 0.379 | 0.364 |

| Energy consumption intensity YoY (%) | % | ① | Common space | 95.33 | 94.88 | 97.86 | 94.43 | 95.99 |

② Consolidated. (Includes overseas and subsidiaries)

GHG emissions volume

| Unit | Scope*1 | Boundary | FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | |

|---|---|---|---|---|---|---|---|---|

| Scope 1 | t-CO2 | ① | Common space | 13,731 | 15,977 | 15,271 | 13,840 | 14,627 |

| Scope 2 | t-CO2 | ① | Common space | 230,161 | 225,500 | 213,468 | 193,771 | 178,153 |

| Scope 1, 2 | t-CO2 | ① | Common space | 243,892 | 241,477 | 228,739 | 207,611 | 192,780 |

| Scope 1, 2 (overseas) | t-CO2 | Overseas | Common space | 39,929 | 60,292 | 60,113 | 61,532 | 64,253 |

| Scope 1, 2 (Japan + overseas) | t-CO2 | ② | Common space | 283,821 | 301,768 | 288,852 | 269,143 | 257,032 |

| Scope 3 | t-CO2 | ② | Entire supply chain for business activities | — | — | — | — | 1,311,119 |

② Consolidated. (Includes overseas and subsidiaries)

Fiscal 2020 CO₂ Output Level

Fiscal 2020 CO₂ emissions output level amounted to 0.0286t-CO₂ per square meter.

Investments to Combat Climate Change

In fiscal 2020, we invested approximately ¥1 billion in energy and resource conservation measures to address climate change. During fiscal 2020, we installed 70 EV charging stations, and as of February 2021, we offer a total of 1,848 charging stations at 138 malls in Japan. In China, we provide 564 charging stations at 14 malls, and in ASEAN we have installed 6 chargers at 3 malls. AEON MALL Ha Dong (Vietnam) offers 20 EV bike chargers for guests.

GHG Emissions Reduction Target

AEON MALL sets GHG reduction targets in keeping with AEON Group policy.

The AEON Group adopted the AEON Eco Project as our group energy strategy for the years 2012 to 2020. Under this strategy, we have been working to reduce energy use by 50% and to create 200,000 kW of renewable energy.

In March 2018, the AEON Group formulated the Aeon Decarbonization Vision 2050, a long-term vision for decarbonization (zero CO₂ emissions) whereby we target zero total CO₂ and other emissions in Japan by 2040. With the goal of reducing energy consumption by 50% in fiscal 2020 compared to fiscal 2010, we have streamlined air conditioning operations, introduced high-efficiency and energy-saving equipment, installed solar systems on mall rooftops and walls, implemented LED lighting, and more. As a result, we have achieved a 55.1% reduction in energy consumption (per unit of floor space) over the aforementioned target period. In addition to these reduction measures, we have set a new goal of operating all AEON MALL locations (large-scale commercial facilities) in Japan with effectively CO₂-free electricity in fiscal 2025 by newly procuring electricity from off-site renewable energy generation and promoting direct renewable energy contracts in each region.

Furthermore, in June 2020, we declared our support for the Task Force on Climate-related Financial Disclosures (TCFD), which focuses on the business risks and opportunities posed by climate change. And, in our climate change impact analyses, we selected the 2°C scenario and the 4°C scenario, with reference to the climate change scenarios presented in the Fifth Assessment Report of the United Nations Intergovernmental Panel on Climate Change (IPCC).

Third-Party Verification

In FY2019, in order to ensure transparency and improve reliability, we received third-party verification of greenhouse gas (scope 1, 2, and 3), water, and waste emissions generated by our company. Using forecasts for improvements derived from this verification, we are working to continuously improve internal information.

●2021 saw third-party verification carried out for AEON Co., Ltd. and for consolidated Group companies. Looking forward, we will work to improve the reliability of our data, and to continue with reductions in our greenhouse gas emissions.

Scope of verification

Verification procedure