Fiscal 2023 Performance Review

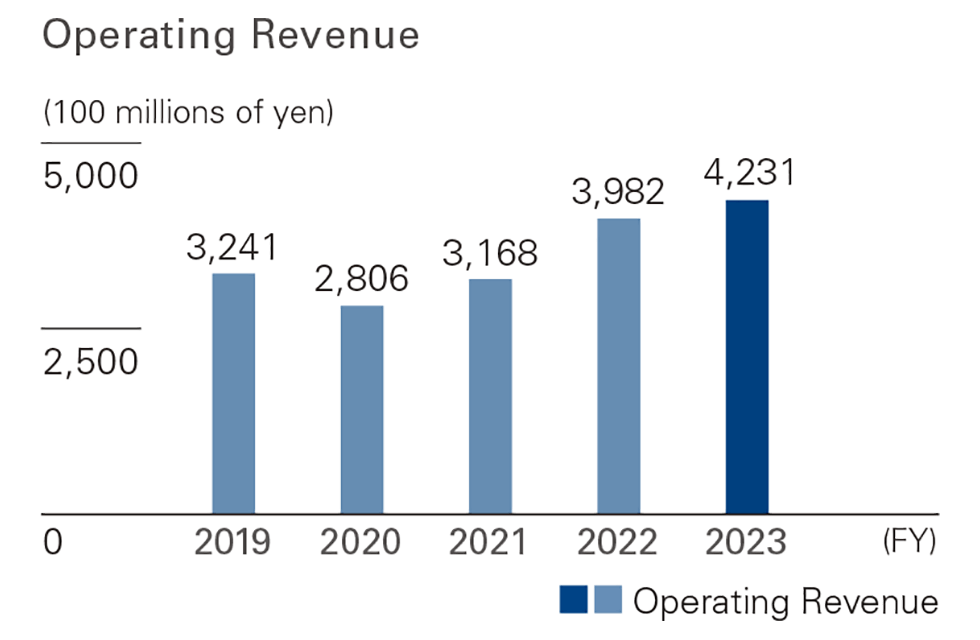

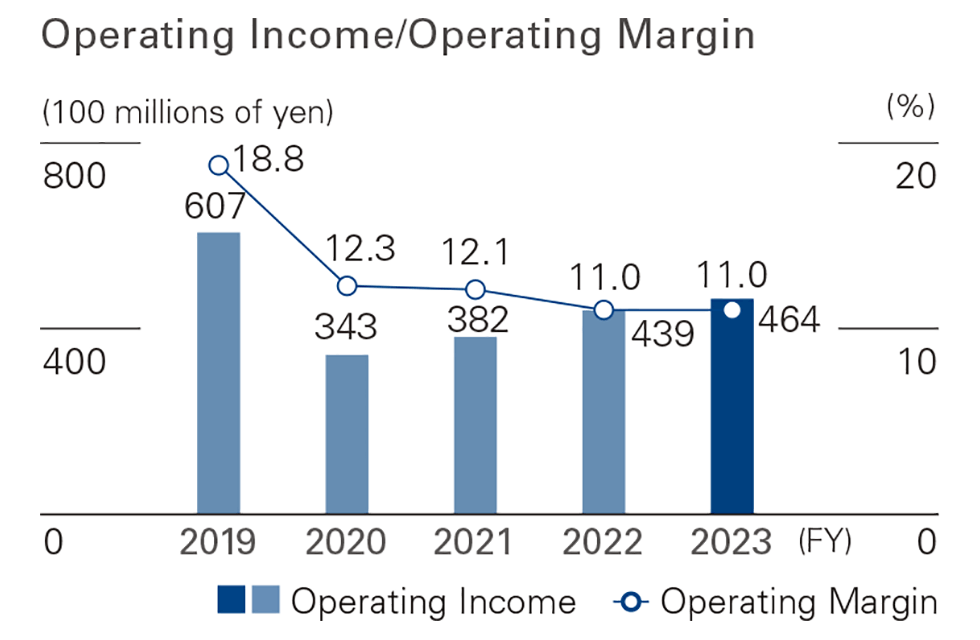

Fiscal 2023 consolidated operating revenue amounted to ¥423.1 billion, a record high and an improvement of ¥24.9 billion year on year. Consolidated operating income amounted to ¥46.4 billion, an improvement of ¥2.4 billion, and we posted higher profits at each stage of measurement. The markets in Japan and overseas entered the post-COVID-19 era, and while there were differences in recovery status across countries, AEON MALL sales and customer traffic overall continued to improve.

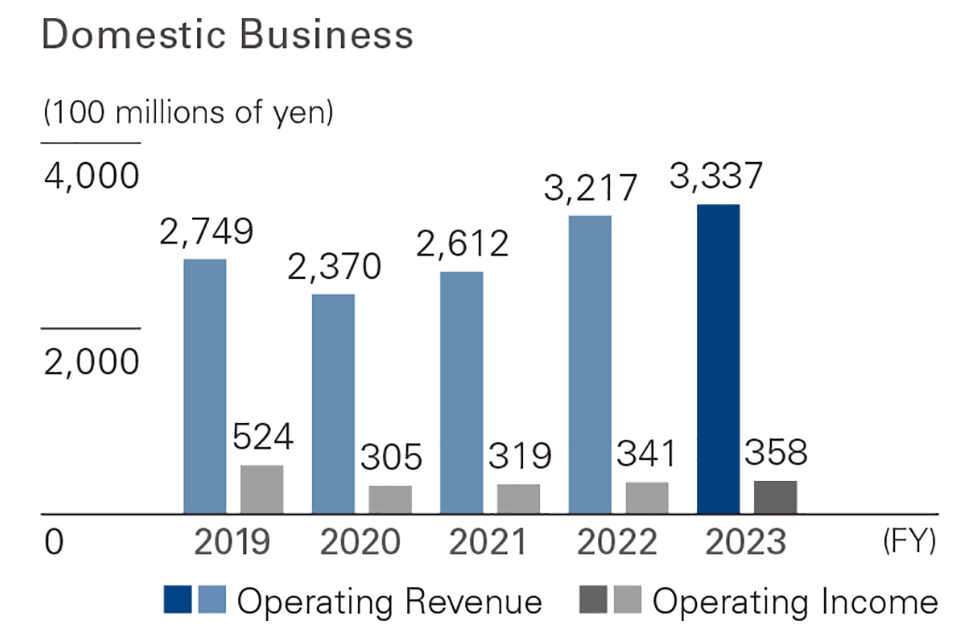

In Japan, operating revenue was ¥333.7 billion, up ¥12.0 billion from the previous year. Operating income was ¥35.8 billion, up ¥1.7 billion. The Japanese government reclassified COVID-19 to a Class 5 disease in May 2023. With customers more willing to leave the home, specialty store sales at existing malls were +5.6% year on year, which also resulted in an increase in lease income percentages. On the cost front, factors such as soaring electricity prices and increased labor costs due to higher wages put upward pressure on expenses.

However, we endeavored to curb costs by switching to new electric power options and reducing electricity rates through the installation of solar power generation systems, among other measures.

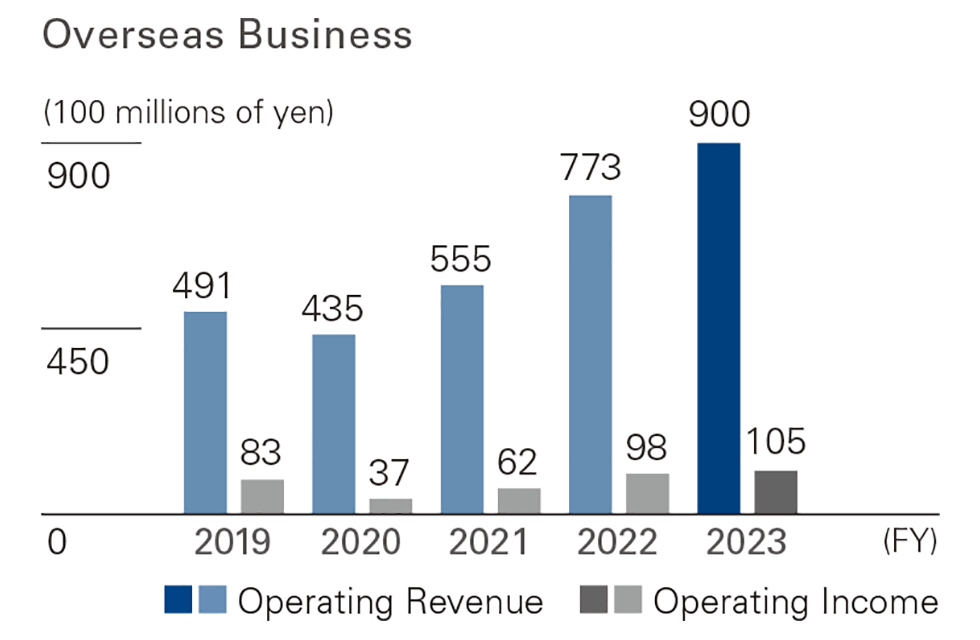

Overseas, operating revenue amounted to ¥90.0 billion, an increase of ¥12.6 billion year on year. Operating income marked a new high at ¥10.5 billion, an improvement of ¥0.7 billion.

China saw a profit decrease of ¥0.09 billion year on year, while Vietnam posted an increase of ¥0.8 billion. Existing malls in Vietnam delivered steady profit growth despite the partial impact of sluggish external demand and slowed economic growth due to power shortages.

While these results indicate growth in operating revenue and profit, fiscal 2023 profit results fell short of plan across all stages of measurement. In light of the continued performance gaps compared with published plans over the past several years, we will endeavor to improve the accuracy of plans and ensure steady execution.

Toward Improving Financial Indicators

We defined targets for ROIC, EPS growth rate, and net interestbearing debt/EBITDA ratio as three management indicators.

To achieve these targets, we intend to focus on improving profitability in reforming our Domestic Mall Business, which accounts for a particularly large ratio of revenues.

In Japan, we will emphasize investments for renovating existing malls to improve profitability. In particular, we intend to improve facility environments and specialty store mix at malls that have established the No.1 position in their respective areas, aiming to strengthen competitiveness further and generate cash that will serve as a source of growth for the Company as a whole. We anticipate future demographic changes and market contraction to affect certain malls. We are planning efforts to revitalize these malls, perhaps even changing business categories, to meet local community needs.

With a new management structure in place, we are holding deeper discussions within the company to re-formulate our medium- to long-term strategies. Financially, we focused on overseas investments in future growth markets. Going forward, however, we intend to establish a muscular financial base by clarifying the order of priority for domestic and overseas investments and conducting well-balanced management.

We will provide disclosures of this new financial strategy to our stakeholders once our stance has been finalized.

Managing Director

In Charge of Finance & Accounting