Long-Term Vision

KPIs

The following represents our financial targets. We work to maximize cash flow and increase corporate value, taking into account the application of IFRS 16 to our overseas consolidated subsidiaries in FY2019.

Financial Targets Under Our Long-Term Vision

The Company recorded the following indicators for the fiscal year ended February 2023.

Results for FY2022

(Notes 1) EPS: net income attributable to owners of parent/average outstanding shares during the year

(Notes 2) Net interest-bearing debt/EBITDA ratio: (interest-bearing debt - cash and cash equivalents) / (operating income + depreciation and amortization on the statement of cash flows)

(Notes 3) ROIC: Operating income x (1-effective tax rate) / (average equity for the fiscal year + average interest-bearing debt for the fiscal year)

Policies and Strategies

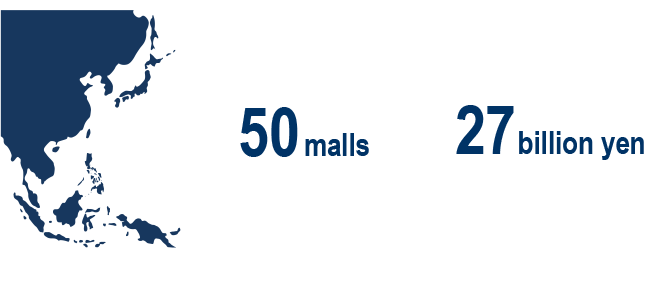

AEON MALL has defined our Vision for 2025 and established measures to make this vision a reality.

Our basic philosophy is that the Customer Comes First and our management philosophy states that AEON MALL is a Life Design Developer, Creating the Future of Community Living. To achieve these ideals, we pursue the following goals for FY2025.

<Vision for 2025>

Medium-Term Management Plan Established by Backcasting

To achieve our Long-Term Vision, AEON MALL created a new medium-term management plan beginning with the fiscal year ended February 2024 (fiscal 2023). The plan runs through the fiscal year ending February 2026 (fiscal 2025). In addition, we aim to achieve sustainable growth together with local communities through the creation of social and economic value through management based on an ESG perspective.