Overview and Forecast

Overview and Forecast

Accelerating growth with dominant strategy in China and the ASEAN region

We are accelerating the multifaceted development of attractive malls in growth areas in Asia where the number of middle-income earners is growing, taking advantage of our strengths in the mall business we have cultivated in Japan. We are steadily increasing our presence.

Market Trends

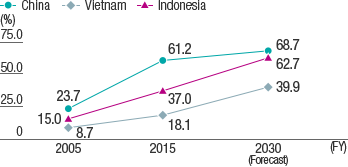

The consumer market is expanding, driven by the growing number of middle-income earners.

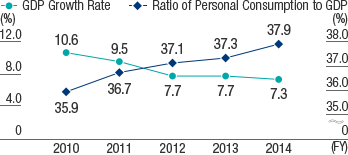

China is shifting its economic development model under the New Normal from export- and investment-driven growth to a domestic demand model that focuses on consumption and services. Personal consumption accounts for more than 35% of China’s GDP, and it is expected to rise further in the future and reach the level of developed nations (60% in Japan and 70% in the United States). Driven by the sharp increase in the number of middle-income earners, retail sales are showing a double-digit growth, and the consumer market is expected to expand further.

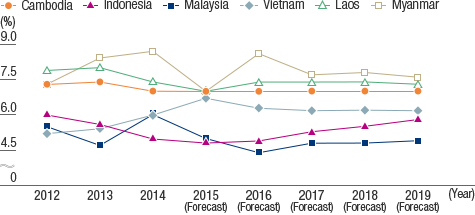

In the ASEAN region, there are also concerns that economic growth may slow down temporarily. However, high growth rates are expected to continue over the medium to long term, given that the average ages of citizens in ASEAN nations are somewhere between 20 and 29, and that the number of middle-income earners is expected to expand in the future.

*Low-income earners: Annual household disposable income is less than US$5,000.

Middle-income earners: Annual household disposable income is at US$5,000 or more but less than US$35,000.

High-income earners: Annual household disposable income is US$35,000 or more.

*Source: IMF

*Source: IMF World Economic Outlook Database (April 2016)

Strengths of AEON MALL

Using a wealth of mall management and operation know-how cultivated in Japan

In overseas markets, malls are commonly developed by a general developer as part of the mixed use development of residential buildings and offices, which are operated primarily to increase the asset value with the expectation of selling them. AEON MALL, on the other hand, has accumulated a wealth of operation know-how that helps create mall appeal and increase their ability to attract customers as a commercial developer focusing on revenue from the operation of malls. This is the greatest strength of AEON MALL.

In overseas markets, the source of AEON MALL’s competitiveness is the creation of mall concepts tailored to the location and the market area and fine-tuned zoning and merchandising in line with these concepts. The building of facilities from a customer’s perspective, such as a comfortable shopping environment with enhanced amenities, and Japan-quality customer services embodied by tenant employees are highly valued by middle-income earners who look for better products and services.

Overview of Fiscal 2015

ChinaSales of specialty stores at existing malls grew 24%.

Aggressively opened six additional malls.

In China, sales of specialty stores at four existing malls increased 24.9% year on year, remaining higher than the growth rate of 10.7% in overall retail sales in China. We also opened six additional malls in fiscal 2015. Sales remained firm at all malls, centering on AEON MALL Wuhan Jingkai and AEON MALL Suzhou Yuanqu Hudong. In addition to the above, we also opened AEON MALL Suzhou Xinqu in Suzhou, and we put in place a structure that encompasses the city center with three malls. We have also opened AEON MALL Guangzhou Panyu Square in Guangdong Province, a priority area. With these efforts, we will continue working to improve our branding and expand our market share.

| Cumulative figures for January 2014 to December 2014 | Cumulative figures for January 2015 to December 2015 | |

|---|---|---|

| Sales of specialty stores at AEON MALLS*1 | 117.9% | 124.9% |

| Number of visitors to AEON MALLS*2 | 121.4% | 110.8% |

- *1 Three malls for January 2014 to December 2014, and four malls for January 2015 to December 2015 (excluding AEON MALL Tianjin TEDA, which suspended business from August 2015 to December 2015)

- *2 The fiscal year-end of local subsidiaries in China is December 31.

ASEANOpened first mall in Hanoi, Vietnam in addition to first mall in Indonesia.

In the ASEAN region, we moved forward with mall openings in suburban areas, opening our first mall in Indonesia and third mall in Vietnam. We now have five malls in the ASEAN region.

At AEON MALL BSD CITY, the first mall in Indonesia, the number of visitors exceeded 13 million for the first 12 months after it opened, and sales remained strong. Given this, we plan to open more malls in Indonesia in the years ahead.

In Vietnam, we opened AEON MALL Long Bien, the first mall in the Hanoi area. It got off to a flying start, with the number of visitors exceeding 11 million in eight months. Further expansion of the market area is expected in light of the materialization of development plans for offices and schools in the neighborhood.

Received the Eco-Business Awards in the Kingdom of Cambodia.

In October 2015, AEON MALL Phnom Penh received special awards (the Environmental Award and the 3R Award) in the Eco-Business Awards sponsored by the Ministry of Tourism of the Kingdom of Cambodia for its various corporate social responsibility (CSR) initiatives.

Forecast for Fiscal 2016

ChinaPlanning to open a new mall and preparing for the early start of business in seven malls that have already been constructed.

In China, we will maintain growth by continuing to promote the opening of dominant malls and further improving our mall operation, which is our strength.

In recent years, fire-fighting-related procedures have become tighter in China, and the construction work of large commercial facilities has been prolonged. For these reasons, we will open only AEON MALL Hebei Yanjiao, the first mall in Hebei Province, in fiscal 2016. However, we have already commenced the construction of seven malls and plan to open them over time.

The move to construct large commercial facilities has been expanding in the last few years, and they are expected to be screened in the future. Given these trends, we will focus on differentiating our malls from other facilities by improving our branding and operation through the promotion of our dominant strategy. To sustain continuous growth, we will build attractive malls in competitive areas.

ASEANOpened third mall in Ho Chi Minh City.

Preparing for openings in Cambodia and Indonesia.

In Cambodia, we began constructing the second mall after AEON MALL Phnom Penh, and plan to open this new mall in 2018. In Vietnam, AEON MALL Binh Tan, the third mall in Ho Chi Minh City, opened in July 2016. We also plan to open a new mall in Hanoi. In Indonesia, we plan to open three facilities following the favorable response to AEON MALL BSD CITY. We will also work to improve our operation know-how at AEON MALL BSD CITY, and build a scheme to address foreign currency risks and tightening regulations on foreign capital.

In addition to these malls, we have begun considering the prospects of developing new malls in Myanmar and other ASEAN nations.