Corporate Governance

For the long-term and stable enhancement of corporate value, we are working to upgrade our corporate governance functions and to build a system for quick decision making.

- Basic Stance

- Management Structure and Activities

- Relationship with Parent Company

- Remuneration for Executives

- IR Activities

- Basic Concept and Development of Internal Control System

- Basic concept and process for eliminating antisocial forces

- Election of Outside Officers

Basic Stance

Our management philosophy is to be a “Life Design Developer” that creates future lifestyles with local communities based on the principle of putting customers first. We define “Life Design” as expanding various functions to suit the life stages of local customers beyond the framework of commercial facilities and designing future lifestyles that include not only shopping, but getting to know people, developing cultures, and other activities. Basing on our management philosophy, we seek to contribute to the improvement of people's lifestyles and the development of local communities by creating malls in Japan and overseas that are unique to each region in view of localization.

We continue to develop shopping malls as community centers that contribute to the growth of local economies and cultures and become an integral part of local communities according to this basic policy. We believe that taking responsibility for our shareholders, customers, business partners, local communities, employees, and other stakeholders through corporate activities in light of such management policies will lead to the long-term and steady improvement of AEON MALL’s corporate value. To achieve this, we will strive to improve our corporate governance and increase our competitiveness through efficient decision making.

AEON MALL is enhancing its strengths as a commercial developer in the retail industry based on management led by directors with a comprehensive knowledge of the retail business, and is strengthening and maintaining management soundness by employing an auditor system.

AEON MALL hires auditors, and its Audit & Supervisory Board comprises of three outside auditors (including two independent officers). The auditors observe the audit standards established by the Audit & Supervisory Board, audit policies, division of duties, etc., communicate with the directors, the internal audit department, and other employees, attend the Board of Directors’ meetings and other important meetings, receive reports from the directors, employees, and other individuals on their duties, and investigate the operation and property of the head office and other offices, aiming to improve the company’s corporate governance, and express their opinions as necessary.

Under this system, we will increase our management transparency and efficiency and ensure legal compliance and risk control to further enhance the company’s corporate governance system.

Management Structure and Activities

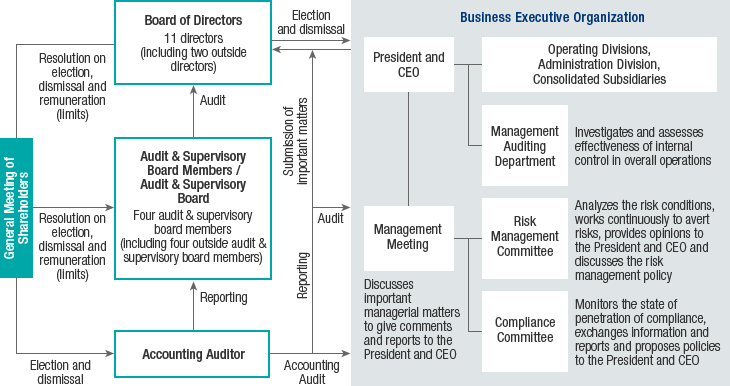

We have established an auditor system and as of the end of February 2016, we have 11 directors (two outside directors) and four auditors (four outside auditors). AEON MALL seeks to improve and maintain its management efficiency by configuring the Board of Directors with members who have a profound knowledge of the company's businesses, and to strengthen and maintain management soundness by enhancing the auditors’ function. As a general rule, the Board of Directors and the Audit & Supervisory Board both meet once a month.

1. Board of Directors

Discusses important managerial matters, policies and key issues concerning business operations. To strengthen its managerial supervisory functions, the President and CEO chairs the Board and it meets at least once a month, with the attendance of four outside directors.

2. Audit & Supervisory Board

Exchanges information and opinions with the Management Auditing Department as an internal auditing body and with the accounting auditor to increase the effectiveness of auditing. Two of the four outside audit & supervisory board members is an independent officer.

3. Accounting Auditor

AEON MALL contracts with Deloitte Touche Tohmatsu LLC to carry out accounting audits under the Companies Act and those under the Financial Instruments and Exchange Act. AEON MALL has no special relationship of interest with Deloitte Touche Tohmatsu LLC or with any of its executive officers who are involved in auditing AEON MALL.

| Name of Accounting Auditor | Deloitte Touche Tohmatsu LLC |

|---|---|

| Remuneration for fiscal year under review*1 | 65 million yen |

| Total amount payable from AEON MALL to the accounting auditor including remuneration*2 | 86 million yen |

- *1 The figure specifies the total amount for the audit under the Companies Act and for the audit under the Financial Instruments and Exchange Act.

- *2 The figure represents the total amount of the economic benefits of AEON MALL and its subsidiaries.

4. Management Meeting

Serves as an advisory body for the President and CEO and discusses, coordinates and makes decisions on matters to be referred to the Board of Directors, matters to be resolved by the President and CEO and important matters concerning business operations to ensure effective management. Comprises full-time directors and outside directors, heads of divisions, business departments and administrative functions, it meets once a week in principle. For governance purposes, one full-time audit & supervisory board member attends every session.

5. Management Auditing Department

To facilitate the execution and control of business operations, seven dedicated personnel collaborate with the heads of individual divisions to investigate and assess internal control on overall operations in terms of its effectiveness and functionality. This department is independent of any on-site operating department.

| Body | No. of sessions | Main members and attendees | |

|---|---|---|---|

| Board of Directors | Chaired by the President and CEO and at least one meeting to be convened each month | 19 | Directors and audit & supervisory board members |

| Audit & Supervisory Board | 15 | Audit & supervisory board members | |

| Management Meeting | An advisory body to the President and CEO, consisting mainly of directors at the levels of managing directors and higher and full-time audit & supervisory board members, at least one meeting to be convened each week in principle | 32 | President and CEO, directors |

Relationship with Parent Company

AEON Co., Ltd., the parent company of AEON MALL, reorganized itself into a pure holding company on August 21, 2008. While focusing on the retail business centering on the general merchandising store (GMS) business, AEON Co., Ltd. operates multiple businesses including general finance services and developer services. AEON MALL is handling the developer business as a core company of the AEON Group. AEON Co., Ltd. holds 50.78% of the voting rights of AEON MALL and its affiliates, including 49.86% under its direct ownership*. However, AEON MALL makes managerial decisions on day-to-day business operations independently, while consulting with AEON Co., Ltd. or reporting to it with respect to significant issues concerning business operations. AEON MALL makes decisions on economic and other conditions for transactions with AEON Co., Ltd. and its affiliates in the same manner as for general transactions and they are subject to the approval process of the Board of Directors and other relevant bodies. AEON MALL mutually respects autonomy and independence with AEON Co., Ltd. and other companies in the AEON Group while maintaining close ties with them in an effort to achieve continued growth and development and to increase financial results.

*As of the end of fiscal 2015

Remuneration for Executives

The following shows the total remuneration for each type of executive, the total amount of each type of remuneration, and the number of executives who receive compensation.

| Category | Total amount incl. remuneration (million yen) | Total amount for each type of compensation (in million yen) |

Number of officers in the category | ||

|---|---|---|---|---|---|

| Basic remuneration | Stock options | Expected amount of executive bonuses | |||

| Directors (excl. outside directors) |

203 | 118 | 43 | 42 | 11 |

| Audit & Supervisory Board Members (excl. outside audit & supervisory board members) |

– | – | – | – | – |

| Outside officers | 33 | 33 | – | – | 7 |

- *1 The above includes three directors who retired at the close of the 104th (FY2014) Ordinary General Meeting of Shareholders held on May 21, 2015 and two auditors who resigned, and does not include a director who receives no remuneration.

- *2 Based on the resolution of the General Meeting of Shareholders,

the maximum monetary remuneration of a director is 600,000,000 yen per year

(resolution of the General Meeting of Shareholders held on May 17, 2007);

the maximum remuneration based on stock options is 100,000,000 yen per year

(resolution of the General Meeting of Shareholders held on May 17, 2007);

the maximum remuneration of an auditor is 50,000,000 yen per year

(resolution of the General Meeting of Shareholders held on May 8, 2002). - *3 The total amounts of remuneration shown above include the following:

• Expected executive bonuses of 42 million yen (for seven directors employed by the company as of February 29, 2016, which does not include a director who receives no remuneration and outside directors)

• Remuneration based on stock options of 43 million yen (for ten directors employed by the company as of April 21, 2015, which does not include a director who receives no remuneration)

Policy for determining the amounts of executive remuneration

The amounts of directors’ remuneration are determined within the ranges resolved by the General Meeting of Shareholders, taking into account the positions, performance, etc. The amounts of auditors’ remuneration are determined within the ranges resolved by the General Meeting of Shareholders after a deliberation of the auditors.

IR Activities

The following describes the investor relations activities of AEON MALL.

Prepare and announce the company’s disclosure policy

We prepare our disclosure policy and announce our basic policies, standards for information disclosure, method of disclosing information, and “IR Quiet Period.”

Hold periodical briefings for individual investors

We hold company briefings for individual investors.

Hold periodical briefings for analysts and institutional investors

We hold quarterly briefings for the President and CEO and IR personnel of organizations.

Hold periodical briefings for foreign investors

We prepare English versions of the company’s annual reports, IR website, and other reference materials and publish them at the same time as the Japanese versions. Additionally, we hold quarterly telephone conferences for foreign investors and regularly participate in conferences held in Japan for foreign investors.

Post IR information on the company website

In addition to information on financial results, timely disclosure of materials other than financial data, securities reports, quarterly reports, and shareholders news, we post audio recordings of financial results briefings on our website.

Establish a department for (personnel in charge of) investor relations

We have established the IR Group as a full-time section responsible for information disclosure. (Phone: 043-212-6733)

Other

We hold individual meetings for domestic and foreign investors and securities analysts. In addition, we provide AEON MALL tours and other events at appropriate times.

Basic Concept and Development of Internal Control System

System to store and manage information on directors’ execution of duties

We prepare written approvals, meeting minutes, and other documents required for executive directors and employees to perform their duties based on internal regulations. Documents that have been prepared are stored and managed in a secure, searchable format appropriate for each storage medium, and are maintained in a viewable form as necessary.

The management division specified in the Document Management Rules takes charge of the management of such records and prevents leakage to external parties.

Rules for controlling the risk of operating loss incurred by AEON MALL and its subsidiaries (“the Company Group”) and other systems

AEON MALL designates its President and CEO as the general director of risk management and its heads of divisions as directors in charge of risk management, and develops a system and environment to ensure business continuity and the safety of human lives. The Company Group has established Risk Management Rules with the aim of preventing risks and minimizing the damage from any crisis that has occurred, and strives to reduce danger and damage. It has also designated a management division for each risk category to control the entire Company Group’s risk of loss, thereby preventing damage to its brand value and increasing its corporate value. The Group will respond appropriately to any risk of urgent and serious loss that has arisen through appropriate communication and decision making based on the Risk Management Rules to minimize the damage.

The Risk Management Committee, headed by the Director of the Administration Division, has been established as an organization in charge of the Company Group’s risk management, which discusses solutions to issues in the risk management of the entire Company Group and reports the proceedings of the Risk Management Committee to the Management Meeting, acting as an advisory body to the President and CEO, consisting of directors at the level of managing director and above, full-time Audit & Supervisory Board members, and persons appointed by the President. Important issues are reported to the Board of Directors.

The department responsible for internal auditing performs internal audits according to the Internal Auditing Rules to increase the effectiveness of risk management.

System to ensure the efficiency of duties performed by the company’s directors, directors of the company’s subsidiaries, executive officers, employees who carry out operations, personnel who perform duties as specified in Article 598-1 of the Companies Act, and other persons equivalent to such personnel (“subsidiaries’ directors, etc.”)

The Board of Directors holds meetings once a month, and occasionally when necessary. Decisions requiring the approval of the President or someone higher, which may cause a serious risk that affects the Company Group, are discussed by the Management Meeting and are subsequently approved by the President or resolved by the Board of Directors. In the performance of duties, management responsibility is clarified by providing the authority required for the performance of duties based on the Rules for Job Position Management, Rules for the Division of Duties, Rules for Authority, and Rules for Asking Approval, and Rules for the Management of Affiliates.

As a system to ensure the efficiency of the performance of duties of the subsidiaries’ directors, etc., the Company approves a Group Medium-term Management Plan, annual management goals, budget distribution, etc. that include subsidiaries at the meetings of the Board of Directors, inspects the progress of business strategies and measures in line with such plan and goals on a quarterly basis, and receives reports on other important information.

System to ensure compliance in the performance of duties of the company’s directors and employees and subsidiaries’ directors, etc. and employees with laws and regulations and the Articles of Incorporation

The company focuses on compliance management and complies with AEON Code of Conduct, the code of conduct of the AEON Group, to build better relationships with local communities and fulfill its corporate social responsibility.

A Compliance Committee headed by the Director of Administration Division has been established, which ensures the Company Group’s compliance with laws and regulations, the Articles of Incorporation, and internal rules, points out problems, and discusses solutions. The proceedings of the Compliance Committee are reported to the Management Meeting, and important issues are reported to the Board of Directors. As a contact point for reporting internal problems that prevent disadvantages for the informant, the company has established the Helpline AEON MALL Employees’ 110 hotline (the AEON MALL labor union has separately launched Union 110 hotline). We will also establish a helpline equivalent to that of AEON MALL within its subsidiaries. If any violation of legal compliance regarding these helplines is reported to AEON, the department responsible will carefully investigate the case, take the necessary measures for a confirmed violation based on the internal rules, develop measures to prevent recurrence or have the relevant department develop such measures and implement them throughout the company, and report on the progress to the Compliance Committee.

System to ensure the appropriate operations of the corporate group, comprising the company, its parent, and subsidiaries

Transactions that may cause a conflict of interest in essence between the company and its parent or transactions in a competitive relationship with the parent are examined in detail by the Management Meeting and carried out after being approved by the Board of Directors.

For transactions with Group companies that also include subsidiaries, the department carrying out such transactions performs its duties under the appropriate conditions based on market prices, which does not reduce the profits of the company. In terms of pricing, the company obtains written third-party assessments or other information if an objective evaluation is available and submits the information required for assessment to the Board of Directors and the Management Meeting.

As a system of reporting matters concerning the performance of duties of the subsidiaries’ directors, etc. to the company, the company requires the subsidiaries to report their monthly business performance, financial results, and other details required by the company to the Management Meeting based on the Rules for the Management of Affiliates established by the company. The internal audit department inspects the company and its subsidiaries based on the Internal Auditing Rules to ensure the appropriate operations of the company and its subsidiaries and reports to the President and the Audit & Supervisory Board by means of a written internal audit report.

Matters concerning employees who provide assistance with the duties of the company’s auditors (“Assistants“) when the auditors decide to hire such Assistants, matters concerning the independence of the Assistants from the company’s directors, and matters related to ensuring the effectiveness of the instructions provided to the Assistants

The company selects and appoints Assistants for the auditors upon consultation with the Audit & Supervisory Board. The Assistants will not receive orders or instructions from the directors or any other employees.

The personnel appraisal of Assistants is performed through consultation with the auditors, and personnel changes and reprimanding of Assistants require the advance agreement of the Audit and Supervisory Board.

System of reporting to the company’s auditors

As a system for the company’s directors and employees and subsidiaries’ directors, etc. and employees to make reports to the company’s auditors, the directors and employees report on the management situation, business operation, financial position, progress of internal audits, status of risk management and compliance, and other matters at a meeting of the Board of Directors or the Management Meeting attended by the auditors.

If the company’s directors or employees or the subsidiaries’ directors, etc. or employees discover matters that affect the operations or business performance of the company or its subsidiaries, violations of laws and regulations, or other issues concerning legal compliance, which may cause serious damage to the company or its subsidiaries, or these have been reported by any of such persons, they shall immediately report to the company’s Audit & Supervisory Board. The company and its subsidiaries are prohibited from treating a person who has made such a report in an unfair manner because they have made a report, and will ensure that this rule is clearly communicated to the company’s directors and employees and the subsidiaries’ directors, etc., auditors, and employees.

Matters concerning policies for the advance payment of expenses required for the performance of duties of the company’s auditors and reimbursement and other procedures for the treatment of expenses or obligations associated with the performance of such duties

When the company receives a request for the advance payment, etc. of expenses from auditors based on Article 388 of the Companies Act, the company shall pay such expenses without delay based on the internal rules. The responsible department takes measures regarding the budget required for such payment in every fiscal period.

Other systems to ensure the effective auditing of the company’s auditors

The internal audit department works closely with the Audit & Supervisory Board by, for instance, discussing the details of internal audits with the auditors as appropriate, and performs audit operations in cooperation to contribute to effective auditing by the auditors.

Basic concept and process for eliminating antisocial forces

Basic Stance

From the perspectives of the strict implementation of compliance management and the protection of the company, we are aware that it is our corporate social responsibility to have no relations with antisocial forces, to take a firm attitude towards their unreasonable demands and to reject such demands.

Readiness to Eliminate Antisocial Forces

- In the event of any unreasonable demand from any antisocial force, no individual staff member should deal with it on their own. It is stipulated that we will give an organizational response, including the possibility of civil or penal legal action, after building close collaboration with outside experts and investigative authorities.

- We are a member of the Bouryokudan Tsuiho Chiba Kenmin Kaigi (Chiba Prefectural Citizen Committee Against Organized Crime Groups). In close collaboration with the police, crime prevention associations and other organizations, we will strive to gather information about antisocial forces and gather together information from across the Company, including information collected from our individual business offices. We will also undertake in-house activities to build awareness.

- The company investigates any involvement of its business partners with antisocial forces and eliminates such forces based on the Transaction Management Rules.

Election of Outside Officers

Outside directors have a role of ensuring transparency of the Board of Directors by supervising inside directors and giving advice to the management on the basis of their views. Audit & supervisory board members participate in meetings of the Board of Directors at a position distant from the management to request detailed explanations about directors’ operations as needed to improve the effectiveness of the managerial supervision.

We have no specific stipulated independence criteria for the election of outside directors, but they are elected in accordance with a basic concept according to which outside directors must have knowledge and experience requisite to the auditing of directors’ compliance and operational control and must have no risk of a conflict of interest with general shareholders.

| Title | Name | No. of sessions attended | Activity Descriptions | |

|---|---|---|---|---|

| Board of Directors | Audit & Supervisory Board | |||

| Outside Director | Mami Taira | 18/19 | – | Made the necessary remarks as appropriate, including confirmation from the standpoint of fairness and transparency and indicating issues related to putting policies into practice, based on her knowledge as an accounting specialist and her experience as an auditor at other companies. |

| Masao Kawabata | 14/14* | – | Made the necessary remarks as appropriate, including confirmation from the standpoint of medium- to long-term business growth and indicating the accuracy of management decisions, based on his wealth of experience as a business manager in Japan and overseas. | |

| Outside Audit & Supervisory Board Members | Junichi Suzuki | 14/14* | 10/10* | Made the necessary remarks as appropriate, including confirmation from the standpoint of enhancing the corporate value and indicating the reasonability of decision-making, based on his wealth of experience at the overseas subsidiaries of the Group companies. |

| Yotoku Hiramatsu | 17/19 | 14/15 | Made the necessary remarks as appropriate, including confirmation of the reasonability of management numbers, based on his many years of experience in the administration divisions of AEON Group companies, including AEON Co., Ltd., and his knowledge as an Audit & Supervisory Board member. | |

| Yumiko Ichige | 19/19 | 13/15 | Made the necessary remarks as appropriate, including the confirmation of legality from the standpoint of a minority shareholder and indicating the fairness of intergroup transactions, based on her expertise as a lawyer and her experience as a director and an auditor at other companies. | |

| Makoto Fukuda | 14/14* | 10/10* | Made the necessary remarks as appropriate, including confirmation from the standpoint of accuracy and objectivity and indicating processes leading up to the outcome, based on his wealth of experience and knowledge about finance he developed in the Group companies. | |

*For officers marked with an asterisk (*), the figure specified as denominator indicates the number of sessions of the Board of Directors or the Audit & Supervisory Board convened after his or her assumption of the post.

| Name | Organization | Concurrent Position | Relationship with AEON MALL | Reasons for Election | |

|---|---|---|---|---|---|

| Outside Directors | Mami Taira* | Hayakawa & Taira Certified Public Tax Accountants' Corporation | Partner | No transactional relations | She was elected in the expectation that she will use her good judgment as an accounting expert that she developed as a certified public accountant and tax accountant and her experience as an auditor for other companies in the management of our company. Although she does not have past experience of involvement in the direct management of a company, we have determined that she is capable of performing her duties appropriately as an outside director for the above reasons. She is not from any of AEON MALL’s major shareholders or major business partners, and therefore has no special interest in the company, and we consider that she is qualified as an independent director. |

| Suzuden Corporation | Outside Audit & Supervisory Board Member | ||||

| Iseki & Co., Ltd. | |||||

| Masao Kawabata* | Brainwoods Corporation, Ltd. | Advisor | No transactional relations | He has extensive experience as a business manager of an overseas subsidiary and was elected in the expectation that he will use his experience in the company’s overseas expansion and risk management. He is not from any of AEON MALL’s major shareholders or major business partners and therefore has no special interest in the company, and we consider that he is qualified as an independent director. | |

| English-Speaking Union of Japan | Director | ||||

| Outside Audit & Supervisory Board Members | Junichi Suzuki | Shimoda Town Co., Ltd. | Outside Audit & Supervisory Board Member | Subsidiary | He has ample experience at an overseas subsidiary of a company in the AEON Group and was elected in the expectation that he will use his experience in the company's management, including its business in China and ASEAN region. |

| Hiwada Shopping Mall Co., Ltd. | |||||

| Yumiko Ichige* | Nozomi Sogo Attorneys at Law | Partner | No transactional relations | She has experience and expertise as an attorney for corporate legal affairs and was elected in the expectation that she will use her perspective as a legal expert in the management of the company. Although she does not have past experience of involvement in the direct management of a company, we have determined that she is capable of appropriately performing her duties as an outside auditor for the above reasons. She is not from any of AEON MALL’s major shareholders or major business partners, and therefore has no special interest in the company, and we consider that she is qualified as an independent director. | |

| NEC Networks & System Integration Corporation | Outside Director | ||||

| Sanyo Trading Co., Ltd. | |||||

| Takao Muramatsu | Muramatsu Tax Accountant Office | Outside Audit & Supervisory Board Member | No transactional relations | He was elected in the expectation that he will use his great deal of expertise in tax affairs that he developed in his many years of service at Regional Taxation Bureaus and his experience as an auditor at other companies for the management of the company. He is not from any of AEON MALL’s major shareholders or major business partners, and therefore has no special interest in the company, and we consider that he is qualified as an independent officer. | |

| Besterra Co., Ltd. | |||||

| Serendip Consulting Co., Ltd. |

* Meets requirements for independent directors set out by the Tokyo Stock Exchange